Unplugging Heartbeat Trades and Reforming the Taxation of ETFs

The much-touted tax efficiency of equity exchange traded funds (ETFs) has historically been built upon portfolios that track indices with low turnover and the tax exemption for in-kind distributions of appreciated property.

This rule permits ETFs to distribute appreciated shares tax-free to redeeming authorized participants (APs) and reduce a fund’s future capital gains. ETFs and APs, working together, exploit this rule in so-called heartbeat trades in which an ETF distributes shares of a specific company or companies to a redeeming AP, instead of a pro rata basket of the ETF’s portfolio. The distributed securities are appreciated shares of companies that are on the verge of being acquired in a taxable transaction or that are slated to be removed from the index tracked by the ETF. In the absence of heartbeat trades, the ETF would recognize gain from the sale of the shares.

Through everyday redemptions and heartbeat trades, equity ETFs are able to make tax-free portfolio adjustments and avoid generating capital gains until their shareholders sell their shares. The quasi-consumption tax treatment of ETFs is unwarranted and gives ETFs an unfair tax advantage over mutual funds, publicly traded partnerships, and direct investments by investors. Although these redemptions could be treated as taxable exchanges between the ETF and an AP under substance-over-form principles, given the vagaries of the tax common law, Congress should simply eliminate the exemption for in-kind redemptions. Congress could alternatively limit the exemption to redemptions consisting of a pro rata portion of an ETF’s portfolio. Either alternative would limit tax-free portfolio adjustments and better align the taxable and economic gains of ETF shareholders.

I. Introduction

Investment companies, including mutual funds and exchange traded funds (ETFs), play an ever-increasing role in U.S. financial markets. At the end of 2020, investment companies held total assets of $29.7 trillion, with $23.9 trillion (80%) invested in mutual funds and $5.4 trillion (18%) in ETFs.1 These assets constituted 23% of household financial assets2 and represented 30% of U.S.-issued equities, 23% of bonds issued by U.S. corporations, 15% of U.S. treasury and agency securities, and 29% of municipal securities.3

The growth over the last two decades in U.S. ETFs has been meteoric. In 1999, there were only thirty ETFs of a total of 18,926 investment companies; by 2020, there were 2,296 ETFs of a total 16,127 investment companies.4 ETF assets too have grown explosively from $34 billion in 1999 (out of $7.1 trillion total investment company assets) to $5.5 trillion in 2020 (out of $30 trillion total investment company assets).5

This trend shows no signs of abating. Dimensional Fund Advisors, a large U.S. asset manager, announced in 2020 that it would begin to offer ETFs for the first time in its forty-year history.6 Other large mutual fund providers, including JPMorgan, have also begun to convert some of their mutual funds to ETFs.7

Although ETFs and mutual funds are generally subject to the same regulatory and tax regimes,8 ETFs offer unique characteristics that have driven their explosive growth. Shares of an ETF can be traded throughout the day at a price close to the fund’s net asset value (NAV). In contrast, an investor purchasing or redeeming shares of a mutual fund will pay or receive the closing NAV.9 Intraday pricing facilitates the use of ETFs not only to gain exposure to diversified portfolios but also to engage in hedging transactions, to write and purchase options on them, and to take short and leveraged positions.

In 2019, the SEC finalized rules that facilitate the formation of new ETFs by exempting them from certain provisions of the Investment Company Act of 1940, especially the requirement to obtain an exemptive order prior to launch.10 It also issued an order approving actively traded ETFs, which will potentially allow ETFs to compete with actively managed mutual funds.11 It is clear that the future of public investment company growth belongs to ETFs.

For long-term taxable investors, another important advantage of ETFs over mutual funds is their much-touted tax efficiency,12 which is attributable to two factors. The first is that many large ETFs track indices in which turnover is low, such as the S&P 500 or the Russell 3000.13 Consequently, an ETF that holds the constituent components of an index should potentially realize taxable gains only in limited circumstances, such as when the index changes and the ETF sells appreciated shares or the appreciated shares of a portfolio company are acquired in a taxable transaction.

The more important driver of ETF tax efficiency is Section 852(b)(6), which exempts from tax in-kind distributions of appreciated securities paid to redeeming shareholders. In-kind redemptions, while rare for mutual funds, constitute the DNA of ETFs, as in-kind contributions and redemptions by authorized participants (APs) help to ensure that an ETF’s share price closely tracks its NAV.

In an in-kind redemption, an ETF manager can distribute low basis securities and minimize the ETF’s unrealized gains. Even if an ETF subsequently sells securities in its portfolio because of changes in the index or a taxable merger, these sales may not generate taxable gains if the securities held by the ETF have a high basis or the ETF has capital losses to offset any realized gains. Consequently, an ETF’s taxable investors will not pay tax until they sell their shares.14

Since mutual funds rarely make in-kind distributions, they do not have the same opportunities as ETFs to dispose of low basis securities tax free. When a mutual fund sells shares to rebalance its portfolio or because it experiences net redemptions, such sales may generate capital gains and necessitate further distributions to avoid entity-level tax. All year-end shareholders will be taxed on their share of these gains15 regardless of whether the fund’s taxable gains correspond to the shareholders’ economic gains.

To avoid recognizing gains, a fund manager could sell high basis securities, but leaving low basis securities in the fund would increase the fund’s unrealized gains or overhang for current and future shareholders. Mutual funds generally endeavor to avoid significant overhang, because unrealized gains may dissuade taxable investors from purchasing shares of the fund, since these new investors will be taxed on these past gains when they are realized.16

Primarily because of their tax efficiency,17 ETFs have exploded in popularity, and a significant tax wedge has been created between mutual funds, direct investments, and ETFs without explicit congressional consideration. In essence, many equity mutual funds that offer identical economic exposure as ETFs are now second-class tax citizens.

Even more concerning is that creative tax advisors have now begun to exploit Section 852(b)(6). The financial press has publicized certain structured trades, denominated “heartbeat trades,”18 in which an AP contributes securities to an ETF in exchange for new ETF shares and shortly thereafter—two days or so—redeems the same shares. Instead of satisfying the redemption request with the same basket of securities that would be contributed to create new ETFs shares, the ETF distributes only appreciated securities that are about to be acquired in a taxable transaction or will have to be sold because of a change in the underlying index tracked or strategy followed by the ETF.19

In promulgating Rule 6c-11 in 2019, the SEC specifically permitted ETFs to use “custom baskets,” which include a basket of a non-representative selection of the ETF’s portfolio holdings, in issuing or redeeming securities. This rule provides the securities law blessing for heartbeat trades20 that permits ETFs to make tax-free portfolio adjustments, which neither mutual funds nor individual investors can do.

Another example of the exploitation of Section 852(b)(6) is Vanguard’s launch of ETFs as a separate share class of some of their large mutual funds.21 The principal benefit of this capital structure scheme is that when an AP requests redemption of its ETF shares, the mutual fund distributes its securities to the redeeming AP. These distributions allow the mutual fund to eliminate unrealized gains from its portfolio and thereby benefit both its mutual fund and ETF shareholders.

Vanguard has further turbocharged this capital structure arbitrage by overlaying it with heartbeat trades. The financial press reported that the Vanguard funds used heartbeat trades in 2018 to distribute significantly appreciated shares of Monsanto that were on the verge of being acquired in a taxable transaction by Bayer and thereby avoided recognizing billions of dollars of gains for its mutual fund and ETF shareholders.22

Through a combination of the in-kind redemption rule of Section 852(b)(6) and heartbeat trades, many ETFs offer superior tax treatment to investing through an after-tax IRA: no tax until sale or disposition of the ETF shares, and any gains are taxed as long-term capital gains.23 Although an individual investor who directly holds a portfolio of securities can obtain the same result, an ETF can make tax-free adjustments to its portfolio without triggering taxable gains, which an individual investor generally cannot do. ETFs offer a significant tax advantage over economically similar mutual funds, investment partnerships, and direct holdings of taxable investors. It is certain that creative tax advisers will continue to expand the use of Section 852(b)(6).

Under tax common law principles, heartbeat trades could be treated as taxable exchanges between an ETF and the participating AP. Given the vagaries of the tax common law and the breadth of the current statutory exemption for in-kind redemptions, there is authority to respect the separate treatment of the related contributions and redemptions. Furthermore, solely eliminating heartbeat trades—currently the most egregious tax pathology of ETFs—would still leave intact Section 852(b)(6), which allows ETFs to eliminate, tax free, unrealized gains and serves as a capital gains siphon for mutual funds with ETF share classes.

Congress should revise Subchapter M by eliminating tax-free heartbeat trades, preventing ETFs from siphoning capital gains from mutual funds, and preventing the loss of basis through in-kind redemptions. Although the tax exemption of Section 852(b)(6) has been in the Internal Revenue Code since 1969, this Article argues that Congress should reconsider the exemption for in-kind redemptions by either eliminating the rule or significantly narrowing the circumstances in which it applies. Given that the current regime violates fundamental norms of sound tax policy and costs the Treasury significant revenue,24 Sen. Wyden, chair of the Senate Finance Committee, proposed eliminating Section 852(b)(6) in September 2021.25

The growth of ETFs coupled with the exploitation of Section 852(b)(6) has laid bare some major infirmities of Subchapter M. Given that Subchapter M is over 80 years old, Congress should reconsider the taxation of public investment companies and their shareholders and enact a regime that would aim to better equalize the tax treatment of individual investors, mutual funds, ETFs, and partnerships that invest in public securities.26

II. An Overview of Regulated Investment Company Taxation

Open-end mutual funds, closed-end funds, and ETFs constitute regulated investment companies (RICs)27 subject to taxation under Subchapter M, provided they satisfy certain income and asset tests.28 A mutual fund continually offers to sell or repurchase its shares at net asset value (NAV).29 A closed-end fund does not issue redeemable securities but instead generally raises capital in a public offering, and its shares are then purchased or sold at market price.30 An ETF is an open-end fund that issues and redeems its shares only with certain APs in exchange for a basket of securities, and its shares are listed on a national securities exchange and purchased or sold at market price.31

Although a RIC must generally be a U.S. corporation, Subchapter M modifies the U.S. corporate double tax regime by permitting a RIC to deduct dividends paid against its investment company income and net capital gain dividends paid against its net capital gain.32 These deductions generally ensure that a RIC’s investment company income and net capital gains are taxable only at the shareholder level.33

Subchapter M implements many aspects of a pass-through tax regime: the deduction for dividends paid eliminates tax at the entity level, and RIC shareholders get look-through treatment for their share of a RIC’s net capital gain, tax-exempt interest, and qualified dividends.34 This tax treatment is similar to that of partnerships and S corporations. A RIC can also pass through foreign tax credits to its shareholders if the RIC invests in foreign securities and earns mostly foreign source income.35

Subchapter M does not fully reflect pass-through tax principles. For instance, a RIC’s short-term capital gains are taxed as ordinary dividends.36 In calculating investment company income, a RIC can fully deduct net investment expenses, whereas if the RIC were organized as a partnership or the shareholder directly incurred such expenses, these expenses would probably not be deductible.37 Finally, losses are not passed through to fund shareholders; instead, the losses remain at the RIC level where they can be used to offset future fund-level gains.38

Subchapter M thus reflects both separate-entity and pass-through tax principles.39 The failure of Subchapter M to implement certain pass-through features of Subchapter K can result in temporary over- or under-taxation of RIC shareholders and drive a wedge between a shareholder’s economic gains and losses and her taxable gains and losses. This occurs because Subchapter M does not permit a RIC to adjust the basis of its assets for gains and losses recognized by a departing shareholder or to allocate taxable gains and losses to the shareholders who have economically benefited from these gains or borne the losses rather than to the shareholders who receive distributions.

III. Subchapter M’s Failure to Match Taxable and Economic Income and Loss

A RIC’s NAV is the fair market value (FMV) of its net assets (assets minus liabilities) divided by the number of outstanding shares. It reflects both the basis of a RIC’s assets, including realized but undistributed income and gains, and its unrealized gains and losses. A mutual fund shareholder purchases or redeems shares of a fund at the fund’s NAV, which becomes the shareholder’s basis in the fund shares in the case of a purchase and amount realized in the case of a sale.40 For ETFs and closed-end funds, a seller or purchaser of shares receives or pays the market price of its shares, which may deviate from the fund’s NAV.

Although Subchapter M provides look-through treatment for certain items of investment company income, it mandates separate entity treatment for transactions in dealings in RIC shares. Consequently, a selling or redeeming shareholder recognizes gain or loss based on the difference between the shareholder’s basis in the sold or redeemed shares and the amount realized;41 the gain or loss recognized by a selling or redeeming shareholder does not affect the inside basis of the RIC’s assets.42 When a shareholder purchases shares of a mutual fund, the fund’s inside basis increases by the amount of the purchase price. However, the purchase of shares from another shareholder, e.g., in the case of an ETF, does not affect the inside basis of the ETF’s assets.

The separate entity treatment of dealings in RIC shares, especially mutual funds, can lead to the temporary over- or under-taxation of RIC taxable shareholders, which is illustrated in the following examples.

Example 1: Buying into Tax Overhang

A mutual fund has one shareholder, S1, and one share outstanding. S1’s basis is $10, the fund’s NAV is $30, and the fund has $20 of unrealized gain or tax overhang. All this appreciation accrued while S1 held the share and is reflected in the difference between S1’s basis and the fund’s NAV. S2 purchases a share for $30, the fund’s NAV. Immediately after S2 becomes a shareholder, the fund sells its appreciated assets and recognizes $20 of gain, which will be distributed and taxed $10 each to S1 and S2, provided both remain shareholders when the gain is distributed.

By purchasing shares at NAV, S2 also purchases his share of the tax overhang—$10 (50% of $20).43 Upon the fund’s sale of the appreciated assets and distributions of the gains, S1 is taxed on only $10 of the $20 economic gain that accrued while he held his share, while S2 is taxed on $10 of the fund’s economic gain, none of which accrued while he held his share.

After distribution of $10 to each S1 and S2, the fund’s NAV drops to $20,44 but S1’s basis remains at $10 and S2’s at $30. Thus, S1 has shifted $10 of tax on his economic gain to S2. The over-taxation of S2 will be remedied when S2 redeems his share, and S1 will be taxed on his remaining $10 of economic gain when he redeems his share.

The shifting of the tax from S1 to S2 on the fund’s economic gains occurs because Subchapter M does not have a mechanism to allocate the taxable gains of a fund to the shareholders who have economically earned those gains or to adjust the basis of fund assets by gains recognized by redeeming shareholders. The fund’s taxable gains are simply taxed to the shareholders who own shares when the fund distributes those gains, regardless of whether those shareholders have benefitted economically from those gains. This also occurs when a shareholder purchases shares of a fund that has realized gains but not yet distributed them to shareholders.

Example 2: Buying into Realized Gains

A mutual fund has one shareholder, S1, and one share outstanding. S1’s basis is $10, the fund’s NAV is $30, and the fund has $20 of realized but undistributed gains. S2 purchases a share for $30, the fund’s NAV. Immediately after S2 becomes a shareholder, S1 redeems his share for $30 and recognizes $20 of gain. Assuming the fund does not realize any additional gains or losses, at year end, S2 will receive and be taxed on $20 of realized gain, all of which arose before S2 became a shareholder.

S2 economically paid for the realized gains when she purchased the fund share at NAV. The receipt of the $20 of realized gains is merely a return of S2’s invested capital and not a distribution of a return on S2’s invested capital. Upon distribution of the $20, the fund’s NAV drops to $10, but S2’s share basis remains at $30. S2 has been temporarily overtaxed by $20, which will not be remedied until S2 redeems her share.

Like in Example 1, S2 is overtaxed in Example 2 because Subchapter M does not have a mechanism to allocate the taxable gains of a fund to the shareholders who have economically earned those gains—S1 in Example 2—or to adjust the basis of fund assets by gains recognized by a redeeming shareholder—the $20 recognized by S1 in Example 2.

Subchapter M’s failure to adjust a fund’s basis in its assets for losses recognized by a redeeming shareholder permits fund-level losses to be temporarily used twice.

Example 3: Doubling Up on Losses

A mutual fund has one shareholder, S1, and one share outstanding. S1’s basis is $30, the fund’s NAV is $10, and the fund has $20 of unrealized loss. All this depreciation accrued while S1 held the share and is reflected in the difference between S1’s basis and the fund’s NAV. S2 purchases a share for $10, the fund’s NAV. Immediately after S2 becomes a shareholder, S1 redeems his share for $10, and recognizes a $20 loss.

The fund’s unrealized built-in loss, which lowered the fund’s NAV and was responsible for S1’s tax loss when he redeemed, can offset $20 of future realized fund-level gains when the loss is realized. For instance, assume that the fund immediately sells the assets after S2 invests for $10 and recognizes a loss of $20. If the fund invests the $10 in assets that subsequently appreciate to $30 and are sold for a gain of $20, the realized loss can offset the realized gain. S2 will not have any taxable income even though he has $20 of economic gain and will recognize this gain only when he redeems his shares. The same $20 of loss is thus used temporarily twice, once by S1 and once by S2.

The financial press has become more attentive to the negative consequences of buying shares of funds with realized gains and regularly cautions investors to be wary of investing in funds that are expected to make significant year-end capital gains distributions.45 Many fund families also publish capital gains estimates prior to the record date so that current and potential shareholders can appropriately plan for capital gain distributions.46

The issue of tax overhang (defined as unrealized gains) has been the subject of many studies by financial economists47 and has begun to be addressed in the legal literature.48 Financial researchers have found that overhang can reduce future new investment inflows from tax-aware investors.49 Since managers are generally compensated based on assets under management (AUM), and reduced fund inflows affect their compensation, managers attempt to reduce overhang by strategically realizing gains and losses.50

The issue of managers reducing overhang potentially creates a double conflict between managers and tax-exempt shareholders, and between taxable and tax-exempt shareholders.51 If managers incur trading costs solely to reduce overhang, these trades do not create any alpha for the fund, but instead generate costs that are borne by all shareholders. These trades, however, can benefit both managers and taxable shareholders: taxable shareholders benefit by reduced overhang, and managers benefit by increased AUM. Tax-exempt shareholders, including shareholders who hold fund shares through 401(k) plans, 403(b) plans, and IRAs, would probably never want a manager to execute trades that only provide tax benefits for taxable shareholders and no expected economic benefits for tax-exempt shareholders.52

Given that co-investment by taxable and tax-exempt shareholders is ubiquitous, these conflicts are inevitable. The explosive growth in the assets held in tax-exempt accounts has resulted in many funds having more AUM of tax-exempt shareholders than taxable shareholders.53 The potential conflict between taxable and tax-exempt shareholders may now be a more pressing concern for taxable investors as managers of funds with a high percentage of tax-exempt investors appear to adjust their investment strategies and generate higher annual tax burdens than funds with a lower percentage of tax-exempt investors.54 Since it appears that the percentage of tax-exempt investors in investment companies will continue to grow, because investment companies are the predominant investment option in qualified retirement plans, mutual fund managers may become less attentive to the tax concerns of taxable investors.55

Subchapter M has certain structural shortcomings that can drive a wedge between the economic and taxable income of fund shareholders. The failure of Subchapter M to adjust the basis of fund assets by gain or loss realized by departing shareholders can leave too much or too little fund-level gain for remaining shareholders. The absence of a mechanism in Subchapter M to allocate built-in gain, built-in losses, or realized gains to existing shareholders can lead to new shareholders being taxed on the economic gains, or benefitting from the economic losses, of historic shareholders. These structural deficiencies result in the temporary over- or undertaxation of taxable mutual fund shareholders and may cause managers to undertake uneconomic trades to mitigate these structural limitations.

These problems present significant challenges for taxable investors in mutual funds. The explosion of ETFs over the last two decades has been driven by their enhanced tax efficiency, which has largely eliminated the issue of overhang in practice for their shareholders. At the same time, it has introduced a significant distortion between the tax burdens borne by individual investors, ETF shareholders, and mutual fund shareholders.

IV. The Rise of Exchange Traded Funds

The most important development for public investment companies in the last thirty years is the invention of the ETF.56 The explosive growth in the AUM of ETFs has been driven by the increased demand of market participants for passive investment strategies, greater portfolio transparency of ETFs, real-time liquidity of ETF shares, low fees, and greater tax efficiency of ETFs.57

Recognizing that the growth in the AUM of ETFs required a more accommodating and flexible regulatory regime, the SEC, in 2019, adopted new Rule 6c-11. This rule permits ETFs to operate without the delay and expense of requesting exemptive relief from certain provisions of the 1940 Act, which ETFs had been required to do.58 In particular, ETFs that come within the scope of Rule 6c-1159 will be considered to issue “redeemable securities” under Section 2(a)(32) of the 1940 Act, and ETFs will be regulated as open-end funds.60 These changes will undoubtedly foster new growth in ETFs.

The primary force motiving the growth of ETFs is the overall shift from active management to passive management. In 2019, the AUM of passive U.S. equity funds surpassed that of active U.S. funds.61 The passive benchmarks include not only the traditional equity or fixed income benchmarks, such as the S&P 500, DJIA, and Russell 3000, but also portfolios of companies selected for certain characteristics, such as ESG,62 minimum volatility,63 cannabis,64 and even pet care.65

ETFs combine some features of closed-end and mutual funds but mitigate some of the shortcomings of both. Like closed-end funds, retail ETF investors purchase and sell ETF shares through a broker on an exchange and not from the fund itself. Since ETF shares can be purchased or sold throughout the trading day, an ETF investor does not purchase or sell at the end-of-day NAV as in the case of mutual funds.

The price at which an ETF trades is set by the market, and an investor may sell or purchase at a price different from NAV. A well-known shortcoming of closed-end funds is that fund shares can trade at varying premiums or discounts to NAV, which at times can be significant.66 This prevents closed-end funds from being useful in certain trading strategies67 and may also raise questions as to whether they are suitable investments in ERISA accounts.

Since ETFs are exchange traded, they can be used both in long and short strategies. For instance, if one believes that healthcare stocks would do better than the overall market, one could go long on the iShares U.S. Healthcare ETF and short the SPDR S&P 500 Index. In contrast, it is not generally possible to short mutual funds, and the discounts and premiums in closed-end funds also preclude them from being good candidates for shorting strategies.

The structural innovation of ETFs to overcome the discounts and premiums to NAV of closed-end funds is the role of APs, which are large broker-dealers, such as Merrill Lynch, Morgan Stanley, and Goldman Sachs, authorized by the ETF to create and redeem shares in large baskets denominated “creation units.” ETF shares can generally only be created and redeemed by APs.68 To purchase ETF shares, an AP contributes the appropriate basket of securities to the ETF69 in exchange for shares, which the AP can then sell to retail investors. An AP redeems ETF shares by presenting a sufficient number of shares to the ETF in order to constitute a creation unit and then receiving a specified portfolio of securities from the ETF. The cost of redemption and purchase of creation units is borne by the AP.70

The creation and redemption process helps to ensure that the market price of an ETF share does not vary substantially from the ETF’s NAV.71 For instance, if the NAV of an ETF is $10 and the share price is $9, the AP can short the underlying ETF portfolio for $10, purchase ETF shares on the open market for $9, and request redemption of the ETF shares in exchange for the ETF’s underlying basket of securities worth $10 per share. The securities can be used to close the short sale, which generates a profit of $1 for the AP.72 The increased demand for the ETF shares will increase the ETF share price and eventually eliminate the discrepancy between the NAV and market price.

Similarly, if an ETF’s NAV is $9 and the ETF share price is $10, an AP can short the ETF shares for $10, purchase the underlying basket of securities of the ETF for $9, and then create additional ETF shares that can be used to close the short sale, thereby generating a profit of $1.73 The increased supply of ETF shares will cause the ETF price to decline and eventually eliminate the AP’s arbitrage profits and the discrepancy between the NAV and market price.

The creation and redemption process gives ETFs certain structural advantages over mutual funds. Since APs pay a fee to create and redeem ETF shares, these costs are shifted from the ETF and its shareholders to the APs and indirectly to the purchasing ETF shareholders. Although the purchasing or selling ETF shareholder bears bid-ask spreads and brokerage fees, many ETFs can now be purchased with no commissions.74 But since ETFs must be purchased and sold on an exchange, there is no assurance that an ETF shareholder will be able to purchase or sell exactly at or near the fund’s NAV.75

When a mutual fund shareholder invests or requests redemption of its shares, any creation and redemption costs are borne by all remaining mutual fund shareholders. These costs include record-keeping, and transaction costs from sales and purchases of assets. Mutual fund shares can generally be purchased and redeemed without any fees,76 but many mutual funds have minimum purchase requirements for new shareholders, whereas a shareholder can purchase as little as one share of an ETF.77

When a mutual fund experiences net redemptions—redemptions greater than contributions—the fund can be forced to sell assets to obtain cash to pay redeeming shareholders.78 Such sales generate trading costs and, more importantly, potential tax liabilities for the remaining shareholders if the securities sold are appreciated.

Unlike mutual funds, ETFs do not have to sell shares to satisfy redemption requests. Rather, ETFs distribute securities in kind. Although the economic effect of selling publicly traded securities and distributing the cash to a redeeming shareholder is identical to distributing those same securities to a redeeming shareholder, a sale of securities is a taxable event for the fund, but an in-kind distribution is tax-free under Section 852(b)(6). Through in-kind redemptions, ETF managers can distribute, tax free, low-basis shares and thereby reduce overhang and future fund-level taxable gains.

V. The Origins of Section 852(b)(6)

Section 852(b)(6) now functions as an enormous tax subsidy for the ETF industry.79 It was not enacted after any deliberative congressional consideration to stimulate the formation of ETFs or to correct market failures of closed-end or mutual funds, but was enacted in 1969—twenty-four years before the first ETF—to give relief to mutual funds if they had to make in-kind distributions in rare moments of financial distress. This tiny speck of a provision has become one of the primary engines of ETF growth.

When Congress enacted the predecessor to Subchapter M in the Revenue Act of 1942, it subjected RICs to corporate tax, but because of the deductions for dividends paid, a RIC avoided corporate tax by distributing its gains and income as dividends. Congress did not need to specifically address the treatment of in-kind distributions of property in redemptions because under the General Utilities doctrine such distributions were not taxable.80 This treatment was codified in the Internal Revenue Code of 1954 for both ordinary distributions, including redemptions, and liquidating distributions.81

In 1969 Congress began to carve back the General Utilities doctrine with the enactment of former Section 311(d)(1), which required a corporation to recognize gain on the distribution of appreciated property to a shareholder in redemption of its shares.82 The legislative history to former Section 311(d)(1) is sparse. The genesis of former Section 311(d)(1) was an article in Forbes that described how some insurance companies were buying back their shares using appreciated stock in their investment portfolios without recognizing gain on the distributed shares.83 This article apparently caught the attention of Congress, as this strategy was specifically mentioned in the Senate report accompanying the legislation.84

The legislative history noted Congress’s concern with avoiding tax on the distribution of appreciated property by a corporation in redemption of its shares, but it is puzzling why Congress did not make all transfers of appreciated property out of corporate solution taxable. This provision applied to both redemptions that were treated as ordinary distributions and sales or exchanges, but notably, it did not apply to ordinary distributions such as dividends or to distributions in complete or partial liquidations.85 After the 1969 legislation, it was still possible for a corporation to distribute appreciated property tax free in an ordinary distribution, such as a dividend, and in a complete liquidation.

In the same legislation, but without any discussion in the legislative history, Congress exempted RICs from the gain recognition requirement if the distribution was “ . . . in redemption of its stock upon the demand of the shareholder.”86 Since closed-end funds generally do not redeem their shares upon the demand of their shareholders, this provision was limited to open-end mutual funds.87 One contemporary commentator had suggested that the goal of the exclusion was probably to “minimize the tax on regulated investment companies on the theory that they are but conduits.”88 Consequently, a mutual fund could continue to distribute appreciated property tax-free to its shareholders in redemption of their shares.

Although Congress may have been concerned in 1969 that taxing in-kind distributions could have subjected RICs to double taxation,89 it is likely that in-kind distributions by mutual funds, although permitted under the 1940 Act,90 were probably rare in 1969, and Congress may not have considered the issue important. It is clear that in 1969 Congress did not intend to completely repeal General Utilities, since a corporation could still distribute tax free appreciated property as an ordinary distribution and in a complete liquidation. The tax policy rationale for treating a distribution of appreciated property in a redemption as equivalent to a sale of the property followed by a distribution of the cash, however, applies equally to redemptions, ordinary distributions, and liquidating distributions.

In the Tax Reform Act of 1986, Congress finally eliminated any remaining vestiges of the General Utilities doctrine by requiring a corporation to recognize gain on the distribution of appreciated property in an ordinary distribution, redemption, or complete liquidation.91 But the repeal of General Utilities did not cover RICs, and in the same legislation, former Section 311(d)(1)(G) was simply moved from Subchapter C to Subchapter M and renumbered as Section 852(b)(6).92 The legislative history is silent on why RICs continued to be exempt, but it seems likely that in 1986, in-kind distributions by open-end mutual funds were rare.93

VI. The Mutual Fund Relief Valve of Section 852(b)(6) Becomes the ETF Tax Bonanza

One justification that has been put forth by regulators is that the in-kind redemption rule functions as a sort of relief valve that protects a fund from having to sell assets at “fire sale” prices when faced with significant redemptions.94 Here the focus may not be that such sales would generate taxable gains that could in turn require additional sales of assets, but that forced sales of assets at low prices could harm remaining shareholders. For instance, if a fund were forced to sell assets, it may choose to sell its most liquid assets and leave less liquid assets in the fund. This issue is discussed below in Part X.B.

To assure smaller investors that they will not receive in-kind distributions, most mutual funds have committed to pay certain redeeming shareholders in cash. Under Rule 18f-1, originally adopted in 1971, an open-end fund may elect to commit to pay all redemption requests in cash limited to the lesser of $250,000 or 1% of the NAV of the fund for each shareholder during any ninety-day period.95 Since many mutual funds make this election, in-kind distributions potentially occur only in the case of significant redemptions.96 For ETFs, however, in-kind redemptions are in their DNA as they are one side of the mechanism by which a fund’s market price is brought in line with its NAV.

When assets are contributed to an ETF, the APs will almost always recognize gain or loss, because the APs will not be in control of the ETF,97 and when securities are distributed in redemptions, the ETF will not recognize gain or loss.98 This arrangement gives an ETF manager valuable tax options. First, the manager can sell securities with built-in losses to recognize the losses, which can then be used to offset future recognized fund level gains, and the manager can distribute securities with built-in gains tax free when they want to avoid recognizing gains.99 In addition, given the ability to specifically identify shares that are distributed, a manager can distribute low-basis securities, the gain on which is exempt from tax under Section 852(b)(6).100 These options give ETFs the best of both tax worlds: an ETF manager can adjust tax free the inside basis of the ETF’s portfolio so that it consists of high-basis securities, which reduces overhang, and the manager can recognize fund-level losses that can be carried forward indefinitely and used to offset future fund-level taxable gains.101

The combination of the managerial realization and specific identification options coupled with the exemption of Section 852(b)(6) has resulted in equity ETFs distributing virtually no capital gains dividends over the last decade despite record economic gains and significant portfolio adjustments.102 For instance, from January 2011 through January 2020, the S&P 500 returned 13.22% per year for a total return of 205.67%.103 From 2015 through 2020, 155 companies were added to the S&P 500 and 152 were deleted.104

Equity ETFs and mutual funds typically distribute ordinary dividends, which consist of a fund’s investment income after expenses, such as dividends, short-term capital gains, interest, and securities lending fees. To the extent that the dividends received by a fund are qualified dividends, the fund shareholders may treat the corresponding portion as qualified dividends.105 Equity mutual funds typically generate some short-term capital gains, which are taxed as ordinary income in the hands of shareholders, but the ETFs in Annex 1 have none. Again, the difference arises not because of investment decisions by the managers, but because ETFs avoid short-term gains by using the exemption of Section 852(b)(6).

The quantum of the tax benefits of Section 852(b)(6) is easily observed in the fund-level disclosure of a fund’s taxable gains and the realized but not recognized gains on in-kind distributions. A fund’s statement of operations breaks out the realized gain and losses, including those arising from in-kind redemptions. The annual reports also provide a fund’s built-in gains and losses. These reports demonstrate that the tax benefits of Section 852(b)(6) are staggering.

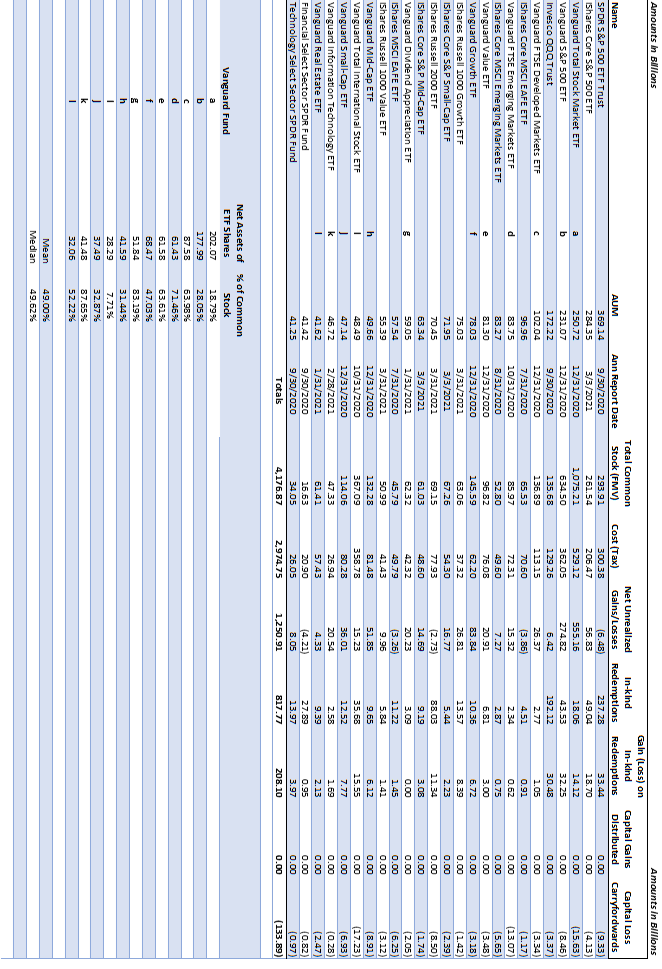

Annex 1 lists the largest (by AUM) twenty-five equity ETFs as of August 15, 2021, from etf.com. These twenty-five funds realized $208 billion of gains from in-kind redemptions for the most recently ended fiscal year, but they distributed $0 of capital gains.

Even while distributing $817 billion via in-kind redemptions, these funds still had cumulatively $1.25 trillion of unrealized gains. It seems that significant positive returns across U.S. equity markets prevented most of the funds from being able to use Section 852(b)(6) to eliminate fund-level built-in gains, although five funds had net built-in losses. The funds with built-in losses realized $48 billion of gains in in-kind redemptions, which is about 25% of the total realized gains from in-kind redemptions of the twenty-five funds.

Many mutual funds that followed comparable investment strategies to these ETFs, but that could not avail themselves of the benefits of Section 852(b)(6), had significant taxable capital gain distributions. Consequently, the after-tax returns to the taxable mutual fund shareholders were less than the after-tax returns to the taxable ETF shareholders.

It is unquestionable that Section 852(b)(6) has imbued ETFs with a significant tax advantage over mutual funds. According to one academic study covering the period from 1993–2017, ETFs distribute annually only 0.1% of capital gains compared to 3.44% for active mutual funds and 1.76% for index mutual funds.106 The difference between capital gains distributions of passive ETFs and mutual funds is even greater for particular investment categories. For the fifteen-year period ending on December 31, 2018, the difference for midcap blend, midcap value, and small cap blend was 3.52%, 3.46%, and 4.21%.107

These differences arise even for funds with the same sponsor. For example, the investment advisor Blackrock offers the ETF iShares Russell 1000 ETF (fund ticker “IWB”) and the mutual fund iShares Russell 1000 Large-Cap Indx Inv A (fund ticker “BRGAX”, Class K), both of which aim to replicate the return of the Russell 1000 index.108

The following table shows that the annual pre-tax returns ending in 2020 of both funds were virtually identical, with most of the difference being attributable to the difference in expense ratios of seven basis points (0.15% for IWB and 0.08% for BRGAX).109 During each year, however, BRGAX, Class K, distributed long-term capital gains, short-term capital gains, and ordinary income dividends, whereas IWB only distributed ordinary dividends.

Annual Returns (%)

|

|

2016 |

2017 |

2018 |

2019 |

2020 |

|---|---|---|---|---|---|

|

BRGAX (K Class) |

11.92 |

21.60 |

-4.85 |

31.28 |

20.84 |

|

IWB |

11.91 |

21.52 |

-4.91 |

31.26 |

20.8 |

|

BRGAX (K Class) - IWB |

0.01 |

0.08 |

0.06 |

0.02 |

0.04 |

The difference in the recognized gains was mostly likely due to portfolio changes or gains realized to pay redeeming shareholders. Since both IWB and BRGAX track the same index, they must adjust their portfolios when the index changes. In 2018, 2019, and 2020, the Russell 1000 added fifty-five, forty-seven, and fifty-four companies and deleted thirty-six, twenty-one, and forty-three companies, respectively, from the index, which in turn required portfolio changes by BRGAX and IWB.110 When a mutual fund makes portfolio adjustments, the fund must generally sell the securities in a taxable transaction, and if the shares are appreciated, the fund will recognize gain.111 When an ETF tracks an index that changes, the ETF must also adjust its portfolio, but the tax cost may be significantly less because of the in-kind redemption process, which helps reduce an ETF’s built-in gains. Because of the realization option, if the securities have built-in losses, the manager can sell them and use the losses to offset any realized gains.112

But how can an ETF that holds appreciated assets and must make portfolio adjustments do so without recognizing gain? For instance, Annex 1 shows that of the top twenty-five equity ETFs, twenty had net built-in gains. Possible explanations are that the portfolio changes were only of securities whose net built-in losses were greater than the net built-in gains, or that the ETF had sufficient capital loss carryovers to offset any realized gains.113 If, however, the adjustments arose because companies were acquired in taxable acquisitions, such acquisitions typically result in premiums for target shareholders, and the ETF would have to recognize such gains, unless the fund had sufficient capital loss carryovers.

The most likely explanation is that ETF fund managers are relying on heartbeat trades, a mechanism that exploits Section 852(b)(6) to ensure that portfolio adjustments, whether arising from mergers, index changes, or a manager’s decision to alter the portfolio, can be done without the recognition of gain. Heartbeat trades have become a tax pathology built on Section 852(b)(6).

VII. Exploiting Section 852(b)(6): Heartbeat Trades and Capital Structure Arbitrage

A. Heartbeat Trades

Imagine that you own a diversified portfolio of shares of ten different companies worth $10 million, and one of the companies, whose shares are significantly appreciated and worth $1 million, is on the verge of being acquired in a taxable transaction. Shortly before the acquisition closes, a bank offers to exchange the $1 million of appreciated shares of the target company in your portfolio for $1 million of additional shares of the remaining nine companies in your portfolio in the same proportion as your portfolio. Immediately after the exchange, you would be in the same position as if you had received $1 million of cash from the acquisition of the appreciated shares and reinvested proportionately the $1 million in additional shares of the remaining nine companies in your portfolio.

For an individual investor, this exchange would clearly be a taxable exchange under Section 1001, because the appreciated shares are being exchanged for non-like-kind assets—the shares of the remaining companies in the portfolio.114 Not so for ETFs and APs, which engage in these exchanges in the guise of so-called heartbeat trades. Using the exemption of Section 852(b)(6) along with custom portfolios, these trades enable ETFs to avoid taxable gains even on appreciated shares that are on the verge of being acquired or disposed of in otherwise taxable transactions.115

The term “heartbeat trade” was coined by financial journalist Elizabeth Kashner in a series of articles published in 2017 and 2018.116 The heartbeat trades were further detailed in an article in Bloomberg Businessweek in 2019.117 The moniker “heartbeat” arose because when a fund’s daily fund flows of contributions and redemptions are graphed, there are significant inflows that are followed shortly after by virtually identical outflows. The resulting graphs appear like those observed in an EKG monitor: most of an ETF’s daily inflows and outflows do not vary too much, but there are significant spikes that resemble a patient’s heartbeat.118

There are various scenarios for which a fund might employ heartbeat trades. For instance, a fund may need to dispose of appreciated securities because a portfolio company may be on the verge of being acquired in a taxable transaction, the constituent shares of a fund’s tracking index could be slated to change, or a particular strategy followed by the fund, such as momentum, minimum volatility, value, or size, requires periodic readjustment or rebalancing of its portfolio.119 These types of trades are referred to as rebalancing trades.120 If the shares that are going to be acquired in a taxable acquisition or deleted from an index or fund portfolio are appreciated, a sale of the shares would generate taxable gains for the fund and its shareholders.

If shares in an ETF’s portfolio have declined or the ETF has had significant inflows and outflows and has been able to distribute appreciated assets, the ETF may not hold significantly appreciated assets. If, however, the market has appreciated and the ETF has not experienced significant inflows and outflows, the ETF may own significantly appreciated assets. As shown in Annex 1, even with the ability to distribute tax free appreciated securities using Section 852(b)(6), twenty of the top twenty-five equity ETFs still hold significantly appreciated assets.121

To avoid taxable gains when making portfolio changes, the ETF works with APs to structure related inflow and outflow trades to remove the appreciated securities from the fund tax-free via in-kind redemptions.122 Before the date on which the portfolio will change (the rebalancing date), an AP contributes creation or custom baskets in exchange for ETF shares equal in value to the appreciated securities that the fund wishes to dispose of. Immediately after the contributions, the fund’s AUM increases by the value of the contributed securities. A short time later, usually two days, the AP redeems the ETF shares created in the inflow leg and receives a custom basket consisting solely or largely of the appreciated shares the fund wishes to delete from its portfolio.123

If these two nominally separate transactions are respected for tax purposes, the distributions of the unwanted securities would be tax-free under Section 852(b)(6), and the fund would have been able to make tax-free fund-level portfolio adjustments.124 After the redemption leg, the fund is roughly in the same position as if it had sold the unwanted shares for cash and then reinvested the cash proceeds in additional shares of the remaining securities of the ETF. An actual sale and reinvestment, however, would have been taxable.

B. Custom Baskets

The ability to carry out heartbeat trades is dependent on the ETF being able to distribute a non-pro rata selection of its portfolio in redemption of its shares. In promulgating Rule 6c-11 in 2019, the SEC specifically permitted ETFs to distribute securities via a custom basket, which is defined to be “a basket that is composed of a non-representative selection of the [ETF’s] portfolio holdings.”125 A contribution of a non-representative selection of the ETF’s portfolio holdings in exchange for ETF shares also constitutes a custom basket.126

Prior to 2012, the SEC did not impose limitations on the use of custom baskets by ETFs, but in 2012, the exemptive orders on which ETFs relied generally required that ETF redemption baskets be a pro rata slice of an ETF’s portfolio holdings, with certain exceptions.127 In particular, the SEC permitted an ETF to distribute a non-pro rata selection of its portfolio in certain situations: when it was impossible to break up bonds beyond certain minimum sizes; to take into account the need to eliminate fractional shares; if the portfolio included short positions, derivatives, and other positions that cannot be transferred in kind; on the days when a fund used representative sampling of its portfolio; and to effect changes in a fund’s portfolio as a result of the rebalancing of the underlying index.128 If there was a difference between NAV and the value of the non-pro rata redemption unit, a fund could use or receive cash to make up the difference.129

The SEC had limited the use of custom baskets because of its concern that ETFs could potentially harm shareholders either through APs cherry-picking certain securities in a redemption transaction or dumping unwanted securities into ETFs in a contribution transaction.130 The SEC recognized, however, that there are situations in which custom baskets can benefit ETFs and their shareholders. For instance, it may be cheaper for APs to assemble or liquidate baskets that consist of a smaller number of securities, which in turn can reduce bid-ask spreads.131 Custom baskets could also help ETFs that hold hard-to-find securities from having to distribute them, or having to distribute cash in lieu of these securities, which could necessitate holding larger than desired cash positions.132

Recognizing the potential benefits to ETFs and their shareholders of employing custom baskets, but also being cognizant of the potential for abuses, the SEC now permits virtually unfettered use of custom baskets. However, ETFs using these custom baskets must adopt and implement detailed written procedures that “set forth detailed parameters for the construction and acceptance of custom baskets that are in the best interest of the [ETF] and its shareholders . . . .”133 These written procedures are internal, non-public documents. Rule 6c-11 also permits ETFs to do heartbeat trades with non-APs on the day of a reorganization, merger, conversion, or liquidation.134

C. AP Motivation for Heartbeat Trades

It is not readily obvious how an AP is compensated for tying up its capital for the duration of the related creation and redemption trades since all transactions between the AP and ETF are done at NAV. The AP must be able to hedge any financial exposure and earn a profit to cover its capital and hedging costs. An AP would not enter into the heartbeat trade without being able to hedge its price risks and cover its capital and execution costs.

Kashner dissects one particular heartbeat trade and demonstrates how the AP and its trading desks can profit on heartbeat rebalance transactions.135 It is important to note that these transactions are not done sui generis by an AP but are part of a highly structured and coordinated operation between an AP and ETF. Without the coordination, an ETF could not be assured that it could distribute the securities in-kind tax free when the rebalancing occurs and match the performance of the underlying index. In turn, the AP would certainly know that it was going to receive a custom basket instead of a creation basket of securities.

In the transaction analyzed by Kashner, for the appreciated shares included in the redemption basket, the AP and its trading desk profited by shorting the shares in the redemption basket at the volume weighted average price (VWAP) and receiving the shares in the redemption basket at their closing prices.136 In the case of actual sales by the ETF, for example of positions with built-in losses, the market makers potentially profited by selling at VWAP and purchasing from the ETF at closing.137 In the case of purchases by the ETF of new securities, the AP and its trading desk profited by purchasing at VWAP and selling to the ETF at closing. Thus, there can be opportunities for the AP, its trading desks, and market makers to benefit from the rebalancing trades.

The costs of these trades may be substantial, especially for an ETF that follows a strategy or an index that requires frequent rebalancing. In the trade analyzed by Kashner, the total profits of the parties working with the ETF were approximately six basis points, which is approximately twenty-four basis points annualized if the ETF rebalances quarterly.138 These are true economic costs borne by the ETF and its shareholders, but since these costs are not explicitly broken out, unlike management fees, they may fall under the radar of investors. In addition, the disclosures by ETFs generally mention custom baskets, but surprisingly do not generally discuss the financial costs of these trades on returns to investors.139

D. The Tax Lollapalooza: Heartbeat Trades and Vanguard’s Capital Structure Arbitrage

The prior subsection discussed how ETFs have employed highly structured heartbeat redemption transactions to ensure that virtually no equity ETF pays any capital gains taxes on portfolio adjustments. Individual investors, however, holding identical securities cannot make the same in-kind portfolio adjustments via heartbeat trades without recognizing gains and losses. Mutual funds also generally cannot use heartbeat trades to offload tax free appreciated securities via in-kind redemptions.

Given the significant benefits of Section 852(b)(6) for long-term taxable investors, creative planners have devised structures that permit ETFs to leverage Section 852(b)(6) and siphon off capital gains from related mutual funds through the Section 852(b)(6) redemption mechanism. The most well-known capital structure arbitrage is that employed by Vanguard.140

Vanguard structures most of its ETFs as a separate share class of their related mutual funds.141 For instance, the Vanguard Total Stock Market Fund Index has both various mutual fund share classes and an ETF share class.142 The mutual fund investors acquire and redeem their shares directly from the fund, but ETF investors purchase and sell their ETF shares through a broker. APs, however, create and redeem ETF shares from the mutual fund.

Structuring ETFs as a mutual fund share class provides potential benefits for both ETF and mutual fund shareholders. Since the ETFs will be part of a larger single asset base, the management expenses will be smaller than if an additional fund had to be created.143 The larger asset base allows a fund to track its index more accurately, since it will not have to do as much sampling while it builds its asset base.144 Market timers, who make frequent purchases and redemptions that impose administrative costs on long-term fund investors, can opt for the ETF class shares, which are better suited to market timing strategies, and thereby avoid imposing costs on other shareholders by their trading strategies.145

Perhaps the largest benefit of the dual class structure is the ability for the fund to distribute low-basis assets to APs when they redeem their ETF shares.146 By itself, the dual class structure does not provide additional tax benefits for ETF shareholders that would not be available if the ETF were structured as a separate fund. But when an AP requests redemption of the ETF shares, the mutual fund can distribute low-basis securities to the AP and thereby reduce any future capital gain exposure for all the mutual fund shareholders, not only the ETF shareholders. Thus, although the AP creation and redemption process arguably adds no financial value for the mutual fund shareholders, except for sharing in fund expenses, the dual class structure allows mutual fund shareholders to share in the tax benefits of Section 852(b)(6), which they could not otherwise do in a mutual fund without the ETF share class.

Annex 1 lists the largest Vanguard equity ETFs and the percentage of common stock the ETF shares represent. The smallest is the Vanguard Total International Stock Fund at 7.71%, and the largest is the Vanguard Information Technology ETF at 87.65%. The mean and median percentages are around 49%.

The dual-class structure presents some possible tax risks to ETF shareholders that would not be present if the ETF and mutual fund shareholders invested in separate funds. Large redemptions from mutual fund shareholders could cause the fund to have to liquidate appreciated positions to pay the redeeming shareholders, and any taxable gains would be shared among both mutual fund and ETF shareholders.147 ETF shareholders could thus pay higher taxes than if they were shareholders in a separate fund. Although this scenario occurred at least once with a Vanguard fixed income fund,148 it has not occurred in a Vanguard equity fund. From 2014 to 2019, the percentage ETF assets of total fund assets for Vanguard’s largest twenty dual class share funds increased in seventeen of the funds, and in eighteen of the twenty funds, the ETF shares experienced greater net fund inflows than the mutual fund shares.149 The increase in ETF assets gives the funds a greater opportunity to use in-kind redemptions to decrease overhang and reduces the risk that a large exit by mutual fund shareholders could cause adverse tax events for ETF shareholders.150

The dual class structure also facilitates converting mutual fund shares to ETF shares. Since both share classes are issued by the same corporation, any exchange of mutual fund shares for ETF shares is tax-free under Section 1036, which permits a shareholder to exchange common stock of a corporation for common stock of the same corporation.151 A shareholder could not exchange tax-free ETF shares for mutual fund shares if the funds were separate corporations unless the transaction qualified as a reorganization.

Vanguard filed a patent for this structure in 2001, which was granted in 2005.152 This probably explains why other sponsors have not replicated the Vanguard structure. Although the patent is of questionable validity, it expires in 2023;153 the door will be potentially open to other sponsors to adopt dual class capital structures, subject to SEC approval.154

The combination of the dual class structure and heartbeat trades has been a tax boon for these Vanguard funds and their shareholders. A 2019 article in Bloomberg Businessweek detailed that since Vanguard added ETF share classes to some of its mutual funds and engaged in heartbeat trades, the funds stopped distributing any capital gains to any of their shareholders.155 The article estimates that Vanguard made more use of heartbeat trades—$130 billion—from 2000 to 2018 than any of its competitors.156

The article further highlights a massive heartbeat trade carried out by Vanguard Total Stock Market Index fund in connection with the taxable acquisition of Monsanto Co. by Bayer in 2018. On the verge of the acquisition, an AP purchased $1 billion of the ETF VTI shares and two days later, it redeemed the same amount, which represented most of the $1.3 billion of Monsanto shares owned by the fund.157 The fund was one of the largest shareholders of Monsanto and had apparently owned Monsanto since the early 1990s, about a decade before Vanguard launched its first ETFs. The article lays bare the true benefit of the dual class shares for mutual fund shareholders: the ETF’s share of the Monsanto stock was $184 million, only about 18% of the $1 billion that was removed, but the ETF share class was the door through which the fund was able to remove 100% of its taxable gains.158

Vanguard, with its dual class capital structure overlaid with heartbeat trades, is the posterchild of the tax infirmities of Section 852(b)(6). For long-term Vanguard equity ETF shareholders, ETFs potentially offer indefinite deferral of fund-level capital gains, even gains arising from portfolio adjustments in rebalancing trades. The dual class structure enables Vanguard mutual fund shareholders to also enjoy the same tax deferral as its associated ETF shareholders. It is certain that other fund families will consider adopting a similar capital structure to extend the benefit of heartbeat trades and in-kind redemptions to their mutual fund shareholders.159

E. Summary

This Part illustrates how Section 852(b)(6) is exploited by ETFs and APs. The basic redemption and creation mechanism, coupled with the option to realize and carry over losses, reduces fund-level built-in gains and current and future realized gains. Any remaining built-in gain or overhang of an ETF is merely a tax mirage, as custom baskets and heartbeat trades are available to eliminate gains that are about to be realized in connection with index rebalancing, taxable mergers, or other portfolio adjustments. The coup de grâce is adding ETFs as a share class to affiliated mutual funds so that mutual fund shareholders can also share in the in-kind redemption tax spoils.

These tax gambits drive a wedge between the after-tax returns of ETFs and other investment vehicles such as mutual funds without an ETF share class, partnerships, and directly managed accounts. Although these trades satisfy the statutory requirements of Section 852(b)(6), i.e., they are distributions in redemption of a fund’s stock, whether the form and purported tax results of these transactions should be respected is discussed next.

VIII. Tax Common Law and Heartbeat Trades

In interpreting statutory tax provisions, courts have developed a panoply of common law doctrines that can be applied to recast the tax treatment of a transaction or series of transactions. These include the substance over form, business purpose, and step transaction doctrines, and they play an especially vital role in the interpretation of U.S. corporate tax provisions.160

Although these doctrines are pervasive and regularly applied to transactions by courts, regulators, and tax planners, determining whether they will or should be applied is often far from certain.161 One difficulty is that each disparate area of the Code where these doctrines have been applied has its own statutory and regulatory requirements and underlying policy concerns. Furthermore, over time, the analytical approach applied by courts and administrators has evolved. Nonetheless, heartbeat trades certainly raise significant substance over form issues.

A. Can Substance over Form be Applied to Pull the Plug on Heartbeat Trades?

Under the substance over form doctrine, the U.S. tax rules are applied to the economic substance of a transaction rather than to its form.162 This doctrine has been applied to all corners of the Internal Revenue Code, including the distinction between debt vs. equity,163 reorganization vs. liquidation,164 reorganization vs. sale, and dividend vs. compensation,165 just to mention a few.

One variation of the substance over form doctrine is the step transaction doctrine under which ostensibly separate transactions are disregarded or stepped together, and the transaction is taxed in accordance with the resulting aggregated or recharacterized transaction. Courts and the IRS have developed various formulations of the step transaction doctrine that determine when it will be applied: the end result test, the mutual interdependence test, and the binding commitment test. When these tests should be applied, however, is often difficult to determine.166

The binding commitment test is the narrowest formulation of the step transaction doctrine, and it steps together transactions only when there is a legally binding commitment to complete another step or series of steps after a first step is taken.167 The mutual interdependence test focuses on whether nominally separate transactions should be combined because they are so interdependent that the legal relations created by one would be fruitless without the completion of the other.168 Finally, under the broadest approach, the end result test, transactions can be stepped together if they are “prearranged parts of a single transaction intended from the outset to reach the ultimate result.”169

As discussed above, heartbeat trades are highly structured, coordinated transactions between APs and ETFs. An ETF communicates with an AP and divulges the names and sizes of the securities positions that the ETF desires to dispose of tax-free via a heartbeat trade. Based on these communications, the AP then acquires a direct position170 in the ETF shares comparable in size to the value of the securities that the ETF wishes to distribute when the AP requests to redeem its shares. It is certain that the AP knows which securities it will receive from the ETF.

If both the AP contribution and redemption transactions were stepped together, heartbeat trades would be treated as an exchange between the ETF and AP of one portfolio of securities or cash (the contribution portfolio) for a portfolio of different securities (the redemption portfolio). Recast as an exchange of non-identical securities, the heartbeat trade would be taxable to both the AP and ETF.171

Since there appears to be no explicit binding commitment between the AP and ETF to redeem the AP with the custom basket following the AP’s contribution, the binding commitment test would likely not apply. When courts apply the end result and interdependence tests, they examine the parties’ intent and the time between the initial and subsequent transactions.172 Given the structured nature and joint planning involved in heartbeat trades between the AP and ETF, there is clear evidence of an intent to undertake both transactions. Furthermore, the extremely short period between the contribution and redemption legs—generally two to five days—supports treating them as a single transaction.

Without the initial significant contribution by an AP, the ETF would not be able to subsequently distribute via redemption the undesired securities, because the value of shares that are typically redeemed on a given day would be insufficient. Furthermore, it is clear that the AP would not make the outsized initial contribution without planning on requesting redemption of the ETF shares received shortly thereafter. The two transaction legs of a heartbeat trade are clearly related and arguably should be stepped together.173

B. Do Heartbeat Trades Have Sufficient Business Purpose?

Another pillar of the tax common law, especially for corporate transactions, is the business purpose doctrine, under which the form of a transaction will not be respected if there is no business purpose other than tax avoidance.174 The most famous exposition of the business purpose doctrine is Gregory v. Helvering,175 in which the Supreme Court found that a purported reorganization that complied with the statutory requirements would not be respected because there was no business purpose:

Putting aside, then, the question of motive in respect of taxation altogether, and fixing the character of the proceeding by what actually occurred, what do we find? Simply an operation having no business or corporate purpose—a mere device which put on the form of a corporate reorganization as a disguise for concealing its real character, and the sole object and accomplishment of which was the consummation of a preconceived plan, not to reorganize a business or any part of a business, but to transfer a parcel of corporate shares to the petitioner.176

Since Gregory, the business purpose enquiry has often been employed as one prong of the economic substance or sham transaction doctrine. Under this approach, a transaction can be treated as a sham and disregarded if either the transaction has no real potential for profits apart from its tax benefits or the taxpayer had no non-tax motives and no legitimate business purpose for entering into the transaction.177 This approach is similar to that now required under Section 7701(o) for transactions for which the economic substance doctrine is relevant.178

Two cases in the early 2000s, IES Industries, Inc. v. United States179 and Compaq Computer Corp. v. Commissioner,180 addressed the issue of whether virtually simultaneous purchases and sales by a U.S. corporation over the record date of American Depository Receipts (ADRs),181 which were trading cum dividend and were on the verge of trading ex-dividend,182 were sham transactions.

The ADRs were owned by tax-exempt entities, which could not benefit from any foreign withholding tax levied on the dividends: $1 of dividend subject to a 15% withholding tax would be worth $0.85 to the tax-exempt owner. The tax-exempt entity would loan the ADRs to a third party that would sell them cum dividend to the U.S. corporation and then simultaneously repurchase them ex-dividend from the U.S. corporation.183 Compaq and IES engaged in these structured trades to generate capital losses to offset significant realized capital gains.184 Since the cum and ex price of the shares would differ approximately by the amount of the dividend less any withholding tax,185 the taxpayers would recognize a capital loss equal to the difference between the cum and ex prices, and would receive a gross dividend of $1 and a net dividend of $0.85 after the foreign withholding tax.186 Consequently, to the U.S. corporation, $1 of gross dividend was worth $1 ($0.85 gross receipts plus the $0.15 foreign tax credit for the withholding tax) plus the tax benefit from the $0.85 capital loss.

The government prevailed in Tax Court against Compaq and in the Iowa District Court against IES. Both lower courts focused on the issue of determining whether the taxpayers had a reasonable possibility of making a pre-tax profit from the transactions. In IES, the Iowa District Court found that the structured trades did not change IES’s economic position and were “solely shaped by tax avoidance consideration, had no other practical economic effect, and [were] properly disregarded for tax purposes.”187

In Compaq, the Tax Court found that the ADR trades lacked economic substance because there was no reasonable possibility of a pre-tax profit. In determining whether there was the possibility of pre-tax profit, the Tax Court rejected including the foreign withholding taxes as additional income and instead analyzed the transaction on a cash flow basis, concluding that the transaction had a net economic loss.188 The Court also concluded that given the highly structured nature of the various ADR trades, the taxpayer had no market risk and thus no business purpose for the trades.189

Both cases, however, were reversed on appeal. In Compaq, the Fifth Circuit Court of Appeals treated the foreign withholding taxes as income from the transactions and found that Compaq had a reasonable possibility of earning a pre-tax profit. This is because the difference between the purchase and sales price was 85% of the dividend, while Compaq received 100% of the dividend, after including the foreign withholding tax.190 After taking into account both U.S. and foreign taxes, Compaq showed a net profit of $1.3 million.191

In IES, the Eighth Circuit Court of Appeals similarly held that the transactions were not shams and should not be disregarded for tax purposes. The court found that the economic benefit to IES was the gross amount of the dividend, and since the price paid exceeded the selling price by the net amount of the dividend, IES made a profit.192 This was sufficient to demonstrate that the purchase-sale transactions satisfied the economic substance test. Furthermore, the court found that the transactions had sufficient business purpose on the basis of IES’s vetting of the transactions with its legal counsel, assumption of risk of loss (albeit a minimal risk), and due diligence meetings with the promotor of the trades.193

Although the principal issue in determining whether IES and Compaq had the possibility of pretax profit was whether pretax profit should be calculated after the foreign withholding taxes but before U.S. tax or whether both taxes should be treated similarly, and this issue is not present in the case of heartbeat trades, it is possible that an AP may be able to demonstrate that it had a reasonable expectation of economic profit in contributing capital to an ETF and then redeeming the ETF shares received two days or so afterwards. An AP may potentially realize profits on the difference between the cost of the contribution portfolio, to the extent it consists of shares, and the value of the ETF shares received. The AP may also be able to profit from disposing of the shares of the custom basket received from the ETF when the AP redeems.194 This is a factual question that would have to be determined by analyzing the constituent elements of the transaction. Since the AP will certainly hedge the long position in the ETF shares, it is not purchasing the ETF shares with the hope that they will appreciate in value over the duration of the heartbeat trade.

Given that an ETF will generally only distribute appreciated assets, it should be able to demonstrate a pretax profit and a change in economic position, since its portfolio will change. Similarly, an ETF may be able to argue that it has a business purpose in engaging in heartbeat trades. For instance, it may be cheaper for the ETF to dispose of the shares of a custom basket through an in-kind distribution instead of selling them on the open market. Also, if the value of the shares of the custom basket is significant, a sale would generate cash that would either have to be reinvested or distributed, which could affect the ETF’s tracking error or generate increased administrative costs and fees. Against this potential benefit, however, the ETF should net costs to the ETF from the AP’s trading activity with respect to the shares distributed in the custom basket.195

Even if the contribution and redemption transactions are related, and assuming they have insufficient business purposes, it is not clear that they will always be stepped together. In various rulings, the IRS has qualified the application of the step transaction doctrine to related transactions by examining whether the transactions are inconsistent with the purpose and intent of the applicable code provisions.196

C. Heartbeat Trades and North-South Transactions

In Revenue Ruling 2017-9,197 the IRS ruled on the application of the step transaction doctrine to so-called North-South transactions, which occur in Section 355 transactions. In a North-South transaction, one corporation (parent) contributes property to a subsidiary (distributing), which is followed by a spinoff distribution of the stock of another subsidiary (controlled) to parent.198 Both the north and south legs are undertaken as part of the same overall plan. The North-South transactions share some similarities with heartbeat trades: there is contribution of property (the south) in exchange for shares followed by a planned, nearly simultaneous distribution of property (the north) to the initial contributor in redemption of the same shares. The main difference is that the north leg is a pro rata distribution in the Section 355 ruling, but it is a redemption in the case of a heartbeat trade.

If the two legs of the North-South transaction were stepped together, the transaction could be recast as if parent had transferred property to distributing in exchange for a portion of the shares of controlled that are subsequently received via a spinoff.199 The south leg would be a taxable disposition to parent of any assets transferred to contributing instead of a tax-free contribution under Section 351.200 Furthermore, if the property transferred by parent were greater than 20% of the value of shares of controlled, distributing would fail the requirement that it transfer control (80% or more) of distributing shares under Section 355(a)(1)(D), and distributing would have to recognize gain under Section 311(b).

In determining whether the North-South transactions should be stepped together, the IRS stated that it would examine the “scope and intent underlying each of the implicated provisions of the Code.”201 The ruling stated that a taxpayer’s form will be respected unless: there is a compelling alternative policy; the effect of all or part of the steps of the transaction is to avoid a particular result intended by otherwise-applicable Code provisions; or the effect of all or part of the steps of the transaction is inconsistent with the underlying intent of the applicable Code provisions.202