Shadow Contracts

This project explores side letters in private market funds. Side letters, separate agreements between a fund and an investor, act as an invisible amendment to the main contract. This article introduces a new use case for side letters: impact investments, where funds target social, as well as financial, returns. Using a hand-collected data set, we examine the scope and role of side letters in this growing space. Side letters as “shadow contracts” demonstrate the Easterbrook/Fischel theories in action, namely that parties “write their own tickets,” tailoring agreement terms to their specific needs within the framework of corporate governance rules. Expressing preferences and constricting manager power through contracts is even more important when managers serve dual goals. However, side letters come with costs, including direct transactional fees and indirect costs such as additional complexity, slower adoption of best practices, and hidden hierarchies that advantage some parties to the detriment of others. The solution? Standardization and transparency. Common side letter provisions, such as information rights and advisory committees, should be addressed in the main agreement to reduce costs, increase transparency, and push contract innovations out of the shadows. Further, in line with recent SEC proposed rules, side letters should be disclosed.

I. Introduction

Contracts are legal artifacts that represent the best expression of parties’ agreement at the time that the deal is struck.2 Written contracts guide parties’ actions and courts’ interpretations after the agreement is made.3 When contract terms change through amendments, addendums, modifications, or substitutions, they are usually agreed to by all parties, attach to the original contract, and visibly alter performance obligations going forward.4

What happens when the mechanisms of change occur by the agreement of some parties and are not made visible to all parties?5 That is exactly what can happen with side letters, also called side agreements, which are ancillary bargains struck by some, but not all, parties to the original contract.6 Even in contracts with multiple parties, sides letters can be negotiated between a subset of parties in secrecy to create individualized benefits reserved exclusively for the recipient of the side letter.7 Once finalized, a side letter between some parties changes the deal parameters in a way that can affect all parties.8 Side letter terms create both direct effects, like granting preferential liquidity rights, and indirect effects, such as when side letter provisions change manager incentives. For example, a side letter can include an excuse provision that allows the LP to sit out a particular investment. An excuse provision for one investor can change the investment landscape for all investors by leading the fund manager to avoid an otherwise attractive investment opportunity because it conflicts with the excuse provision, and as a result changes the capital pool available. Side letters thus act as a shadow contract changing the contours of the original deal on the side.

Inquiries into how contracts operate are central to larger questions of corporate law. Consider the nexus of contract theory advanced by Michael Jensen and William Meckling, positing that corporations are a network of contracting relationships.9 Others view corporate boards of directors as mediating hierarchies tasked with balancing the interests of contract holders.10 Further still, corporations are formed by filing articles of incorporation, which courts treat and interpret as contracts, supplemented by bylaws and other corporate contracts.11 Thus, corporate law’s most central questions are resolved using standard contract-law principles.12

Easterbrook and Fischel famously extended and intertwined corporate and contract law theories, arguing that enabling corporate law statutes in each state provide a loose framework within which parties can dictate their own preferences, resource allocations, and information rights through contracts.13 They conclude that corporate law shouldn’t be more robust because parties can “write their own tickets” and set the rules as they wish, via contracts governing corporate actions.14 They offered a party-agnostic theory of contract primacy as a powerful explanatory framework in corporate law.15 Thus, contracts are central to broader questions of corporate law, as well as economics. Side letters embody the open-ended nature of contracting theorized by Easterbrook and Fischel bounded only by creativity, party resources, and judicial interpretation.

Side letters also typify some of the inherent tensions and contradictions that are central in the contract literature. For example, by design, side letters are modular, meaning divided into standalone segments within the agreement and separate from the main Limited Partnership Agreement (LPA).16 But, side letters are also integrated with the LPA through cross references.17 Even though highly tailored to investor needs,18 side letters share common themes19 and amend boilerplate20 in the LPA.21 The term “contract” does not even have a singular meaning. For example, a side letter is a standalone agreement, but can only be understood as part of a “bundle” of agreements related to the investment.22 In private market funds, the “bundle” commonly includes the LPA, investor subscription agreements, and side letters. Thus, studying side letters adds depth to current debates about contract design and contracts’ role in shaping corporate theory. Further still, contracts are a useful vehicle to examine the power of private, for-profit actors to contribute solutions to existential questions of climate risk, social inequities, and sustainability.23 In prior work, we studied impact investment contracts24 to explore greenwashing and contracting practices that align manager incentives to serve dual goals, e.g., profit and purpose.25 Contracts morph and change as circumstances require, and we see evidence of their changing in response to new goals with tailored provisions in side letters. Impact funds are best understood as a subset of private market funds, making our findings relevant to both literatures.26

In this paper, we introduce a novel data set of 79 side letters to impact investment agreements, part of a broader effort by the Impact Finance Research Consortium (IFRC) to gather legal, financial, and other information on the performance and structure of impact investing funds.27

This article has three main contributions. First, we shine a light on an understudied aspect of contracting: side letters. Side letters are extremely common and increasingly complex. Yet few academic articles highlight their role in shaping contractual relationships.28 We connect our findings to broader themes in contracts, impact investing, and corporate law. We argue that side letters exemplify the Easterbrook and Fischel notion that corporate parties “write their own tickets” through contracts.

Second, we present data on a case study of impact investment side letters alongside interview insights. These data show that side letters help investors document and protect preferences. For example, we find that investors negotiate for information rights and advisory committees that can help ensure their desired balance between dual goals. Confidentiality and other rights are also tailored to fit investors’ mandates, such as carve-outs for public institutions who require transparency to their constituents.

Third, we demonstrate the presence of a trade-off inherent to the use of side letters and propose solutions. Side letters allow funds to promise what they are able to deliver, and for investors to demand what they value.29 At the same time, increasingly complex and tailored contracts can generate substantial transaction costs. When terms are negotiated in the “shadows,” side letters can also result in hidden hierarchies and hamper the adoption of best practices.30 These trade-offs are heightened in settings with heterogeneous investors and emerging best practices, as is the case in impact investing. The impact investment setting compounds transaction costs by reducing the pool of capital that can be invested for impact.

One solution to the cost of side letters is to bring more of the side letter terms out of the shadows and into the main agreements. Our analysis documents variation in language and length of side letter provisions, but also demonstrates common themes in side letter negotiations around information rights, advisory committees, and confidentiality carve outs, among other terms. If most impact deals have a side letter (or more) negotiating these terms, then the LPA and subscription agreement, not a side letter, should address them.

Our article proceeds as follows: Section II describes side letters in private market deals generally; Section III introduces our case study and data; Section IV discusses the costs and implications of side letter practices sending with recommendations; and Section V briefly concludes.

II. Side Letters

Side letters are used in a variety of settings like collective bargaining or other employee union agreements,31 investment banking contracts,32 and a host of other transactions. One arena where side letters are the rule, rather than the exception, is in private equity.33 Side letters tailor investor rights,34 facilitate investments by governments and pensions,35 and authorize ancillary services to funds such as lending agreements.36

This paper discusses side letters in impact investing, a subset of private equity in which funds target social as well as financial returns. In the section below, we describe the landscape of side letters in private equity in general and then in impact investing specifically.

A. Private Market Side Letters

Side letters change main agreements in one of three ways: (1) clarifying terms, (2) correcting or changing existing terms, or (3) adding terms reflecting a new consensus between the parties.37 In practice, side letters in private equity agreements reallocate power and refine rights that generate both efficiencies and costs. For example, increased flexibility and targeted negotiations are two efficiencies.38 On the other hand, side letters introduce additional complexity, stall development of best practices in LPAs and usher in hidden hierarchies, as well as extract costs.39 Before turning to the data, we first describe the landscape in which side letters emerge, and the dynamics that fueled their growth.

We start with the main appeal of side letters: low cost, flexibility,40 and bespoke tailoring. In private equity, side letters cater to and incorporate the idiosyncratic needs of large investors.41 For example, when a pension plan negotiates a fee discount, changes must be made to the investment agreement for the fund to secure the capital.42 Amendments and modifications or a wholesale revision to the investment agreement would implement the change. But these approaches are costly, and it is risky to open the whole deal to renegotiation. Side letters offer a tactical advantage: lower transaction costs.43 In theory, negotiating a limited set of deal points in a side letter involves less time and money than a formal amendment process open to more investors and renegotiations.44 While we later show that some side letters are bloated, within our case study, the majority of our side letters are 10 pages or less.45

Side letters are also flexible, reflecting last minute and after-the-fund-is-formed deal adaptations necessary to attract capital.46 This is particularly true with large investors, those able and willing to invest cornerstone capital necessary to make a fund.47 Large investors hold negotiation power because of their influence over whether the fund raises the minimum capital amount to form. Large investors in one fund are also potential investors in sister or subsequent funds.48 Importantly, large investors can demand idiosyncratic terms within side letters because the capital they invest will foot the legal bill of contract negotiation.49

Side letters are not without their own costs, such as perpetuating poor-quality LPAs. For example, when large investors negotiate for their own private benefits, they are less sensitive to the poor quality of LPA protections that extend to other investors.50 Side letters create a hidden hierarchy.51 Suboptimal LPA terms, such as lack of information reporting or participatory governance, can be repaired in a side letter but left in the main agreement, exposing other investors to weak protections and perpetuating “best practices” that are anything but.52 Some side letter provisions, once complied with for one investor, often cost little to extend the privilege to other investors. Take information rights for example: once a fund produces information for one investor, providing it to all other investors costs the fund nothing.53 We address some of the reasons why parties repeatedly negotiate for such low-stakes bespoke rights below.

Who are the large investors that act as 1000-pound gorillas demanding special contract rights? In practice, a range of investors negotiate side letters, each with their own investment objectives.54 According to a 2020 study by the law firm Seward & Kissel, the six principal investors negotiating side letters in private capital are, in order of frequency: (1) funds-of-funds (42%); (2) government plans (18%); (3) corporate pension plans (15%); (4) endowments (10%); (5) wealthy individuals/family offices (7.5%); and (6) non-profit institutions (7.5%).55 Alternatively, Professors de Fontenay and Nili found that endowments and pension plans negotiated over 60% of the side letters in their sample, followed by foundations (14%).56 In Section III, we discuss foundations and Development Finance Institutions (DFIs) as common investors in impact investing.57 Pushing these investors’ collective negotiation power outside of the LPA and into the side letters stagnates LPA best practice development. Strengthened LPA rights would benefit all investors, not just the parties to the side letters.

Common private equity side letter provisions include most-favored nation clauses (MFNs), advisory committees, information rights, separately managed accounts, and tax compliance.58 Controversial side letter provisions include management fee and carried interest discounts, which increase an investor’s potential return.59 Large investors also negotiate co-investment rights to invest directly in portfolio companies alongside the fund, thus granting the investor double access to the portfolio company and a greater chance of returns.60 Collectively, these side letter terms allow preferred investors to strengthen their claims to returns and relative position in the fund.61

Recently, the SEC weighed in on the practice, issuing guidance on investor risks associated with hidden hierarchies in side letters.62 Private fund investment advisors fail to make adequate disclosures, and run afoul of the SEC, when they do not inform fund investors after other investors negotiate preferential liquidity terms.63 The side letters in question fundamentally changed the risk exposure to the other investors in the fund. Failure to disclose these special terms meant that some investors were unaware of the potential harm that could be caused by select investors redeeming their investments ahead of other investors, particularly in times of market distortion where there is a greater likelihood of a financial impact.64 In February 2022, the SEC went one step further, proposing new rules for private funds prohibiting preferential liquidity, certain information rights, and other side terms not disclosed to all investors.65

Further, negotiating and complying with patchwork and bespoke obligations introduces transaction costs for the fund.66 Agreeing to and documenting side letters costs time and money. Complex terms with layers of carve-outs, developed across multiple documents, also increase compliance costs over the life of the fund. Side letters with multiple investors increase administrative costs to managers.67 Without limits on side letter provisions or a checklist to monitor performance of all fund side letter agreements, managers can be swamped by compliance obligations.68 The combination of complexity and divergence presents general partners (GPs) with a business risk in complying with the stipulations of one side-letter without falling afoul of another or of the LPA itself.69

B. Impact Investing Side Letters

Impact investing shares much of the structure and dynamics of private equity, but the addition of a non-pecuniary goal generates its own set of pressures as well. Fund managers and investors vary in their impact goals, mandates, and motivation.70 As a result, the need to “write your own ticket” is especially salient in impact investing, elevating the importance of side letters as a tool to document idiosyncratic investment priorities.

Due to the limited literature on side letters, we introduce a novel data set of 79 impact investment side letter agreements, as well as a set of interviews with impact investing stakeholders.71 The mixed methods approach provides a 360-degree view of side letters, stakeholders, and the economic and political reality in which these shadow contracts are negotiated.

For impact investment funds, the large investors demanding special contract rights are typically foundations72 and development finance institutions (DFIs).73 Foundations count impact investments toward their program related investments (PRIs), defined under IRS rules as investments that further one or more of the foundation’s exempt purposes.74 PRIs cannot be intended to primarily produce income: making money can be a byproduct, but not the primary purpose.75 PRIs are counted toward a private foundation’s minimum distribution requirement of 5% per year, but many foundations invest beyond the 5% benchmark.76 For example, one side letter includes the statement:

The parties also acknowledge that the Foundation is purchasing the Interest as a “program-related investment” within the meaning of Section 4944(c) of the Code and are entering into this Agreement in order to allow the Foundation to determine that its investment will be used to further significantly the accomplishment of the Foundation’s charitable purposes.77

Like foundations, DFI investments are motivated by policy.78 DFIs are investors established and funded by governments to achieve policy and social objectives through private investments.79 DFIs are “public” private equity vehicles. For example, the International Finance Corporation (IFC), a member of the World Bank Group, is the largest global DFI with $35 billion of committed capital for FY 202180 contributing to a global impact investment market estimated over $715 billion in 2020.81

DFIs and foundations provide important capital to impact investment funds for the same reason as any large investor in private market funds—they represent a large infusion of capital and potential investments in subsequent ventures. DFIs and foundations hold additional bargaining power in impact investing funds because they regularly accept concessionary (below-market) returns even in funds aiming for market-rate profits.82 Foundation capital,83 sometimes called catalytic capital, may “anchor” a project by providing stable capital with lower expected returns.84 It can also give an unproven fund region or impact focus the capital necessary to build financial capacity and proof points, which will then allow the fund to attract non-foundation capital.85 Similarly, interviewees report that DFIs also attract other government-backed investors by providing cornerstone capital, a practice referred to as “club investing”.86 DFI capital provides a strong branding advantage for wider fund-raising among individual investors more willing to invest after a DFI-stamp of approval, and for later fund raising in subsequent funds.87

Fund managers, whether dealing with traditional large investors, foundations, or DFIs, will negotiate special terms for important investors.88 Manager concessions are not always obsequious, but are often driven by foundation and DFI organizational needs. Foundations require unique information to confirm the charitable purpose of the investment and document that the investment satisfies IRS regulations.89 For example, the foundation side letter excerpt below specifically addresses GP obligations to serve the charitable purpose, prevent mission drift, report on any changes, and provide extensive information to the foundation annually.

The General Partner shall use all reasonable efforts to measure the extent to which the MFI’s are [serving the charitable mission] and shall take all customary and reasonable steps that are practicable under the circumstances to monitor its Investments for compliance with its charitable purpose and to prevent Mission Drift . . . .

Notice . . . [a]ny change in circumstances that would cause the Interest no longer to serve the [charitable] purposes stated in Section [X] of the Partnership Agreement . . .

Reporting . . . [i]n addition to financial reports to Limited Partners required under the Partnership Agreement, the Fund shall submit to the Foundation at least once a year . . . a statement signed by an authorized officer of the General Partner certifying that the Fund and the General Partner are in compliance with the terms of this Agreement.

The General Partner shall provide the Foundation access to all information the Foundation deems relevant to evaluating the Fund’s activities, including any and all reports produced by the General Partner, the Investment Committee, or the Investor Advisory Committee pertaining to the performance of the Fund.90

DFIs, as quasi-governmental actors, also have unique reporting mandates from sponsoring governments and oversight obligations including rigorous financial accounting.91 DFIs also often require documentation that their investment dollars are serving stated policy objectives and are not being used for prohibited activities such as child labor, nuclear weapons, or money laundering.92 One DFI side letter states: “If the General Partner has knowledge . . . that a potential investment in a Portfolio Company is a Prohibited Investment . . . the General Partner will so notify the Investor and . . . a description of the activities that it reasonably believes render such an investment a Prohibited Investment . . . .”93 Prohibited investments are also defined in this side letter covering a range of military and civilian weapons.94 Where each DFI has its own unique set of reporting mandates and prohibited activities, side letters are negotiated and agreed to for each, to accommodate the investor’s need.95

In our empirical analysis in Section III, we show that side letters share common themes. For example, they frequently address information rights, advisory committees, MFNs, and compliance, among other topics. But side letters are neither uniform nor simplistic (see e.g., Figure 6). Our document analysis reveals a wide range in the length, content, and complexity of side letters.96 We make recommendations in Section IV to better address investors’ needs.

C. Costs of Side Letters

Side letters extract real dollars from impact investment deals through increased transaction costs and complexity. Negotiating and tailoring terms in side letters increases the transactional costs of impact deals. Side letters, reported to once be twenty-page documents, now loom as large as forty-five pages according to one interviewee.97 Side letters in our sample extend to seventy-nine pages, although the majority are under ten pages.98 One interviewee reported legal costs of $1.5 million incurred by a single fund, the bulk of which corresponded to side letter negotiation with multiple DFIs.99 The standard legal cost of side letters is more routinely estimated at $10–15,000 per impact investor, which again suggests significant idiosyncrasies.100 Where impact investors, specifically DFIs, provide the bulk of the capital, they bear the full cost of negotiation as the GPs’ costs are charged to the fund and, therefore, the investor.101 Side letter negotiations also extract opportunity costs, with negotiations lasting between twelve to eighteen months creating a material delay.102

Once a targeted intervention, side letters have become a source of contention in impact investing.103 Three factors drive the current situation. First, contract templates used by legal firms contain default terms like confidentiality provisions developed for non-impact deals (i.e., deals without public and policy objectives) that are a poor fit for the impact objectives and blend of private/public objectives.104 Second, and perhaps more pervasive, embedded norms around confidentiality and proprietary investment pipelines in private market finance105 have been imported into the impact space, even when they are not well-adapted to the needs of impact.106 Sophisticated deals tend to have such protections, so the absence is unfamiliar, if not uncomfortable. These norms are “sticky” where lawyers for funds and investors have incentives to protect proprietary forms and charge billable hours for repetitive customization.107 Professors de Fontenay and Nili also describe a perceived slippery slope where funds and lawyers are over-protective of LPA terms, believing any deviation lowers the negotiation bar for all future fund negotiations, whereas side letters offer less visible and less permanent modifications.108 Third, side letters are perceived as easy-to-implement solutions, particularly for DFIs and foundations adjusting to changed policy goals and program requirements.109 Side letters may seem like an efficient vehicle to resolve bespoke information and oversight needs, but they can present concealed costs in negotiation, implementation, and oversight. These three factors create preferences and path dependencies for suboptimal LPA terms that require remediation in a side letter.

III. Impact Investing: A Case Study

The scant private markets literature notes the following common side letter provisions: management fee discounts,110 co-investments,111 confidentiality and information rights,112 MFNs,113 and advisory board seats. How often do we see these provisions, and others, in impact investment side letters? This case study adds to the literature by documenting side letter practices in impact investing. It also illustrates the Easterbrook and Fischel theory of tailoring contracts to reflect parties’ preferences for risk, return, and here, impact. Our empirical analysis provides a basis for our later discussion of side letters’ costs and benefits.

A. Data & Methodology

We present contract coding data on seventy-nine side letter agreements with impact investment funds. These documents were collected as part of the Impact Finance Database (IFD), an initiative of the Impact Finance Research Consortium (IFRC).114

In 2019–2021, we studied side letters as a part of a private grant. Research partners on the grant approached major DFIs, multilateral development banks (MDBs), funds of funds, and foundations to request access to contracting documents pertaining to their private equity fund investments. European Development Finance Institutions (an association of European DFIs) provided further assistance in reaching out to individual DFIs. All documents collected in the project are subject to strict confidentiality and non-disclosure agreements.

To analyze the contents of the contracts, we developed a contract coding process using contract variables and coding procedures drawn from the legal and finance literatures.115 Questions about confidentiality were developed in conjunction with grant partners and after a review of confidentiality provisions in the existing database. We hired, trained, and supervised law students to record the presence or absence of terms, record variations within provisions, and quote relevant language from the contracts. Text responses verify coding entries, control for accuracy, and extract additional information on observable trends and nuances in contract provisions.

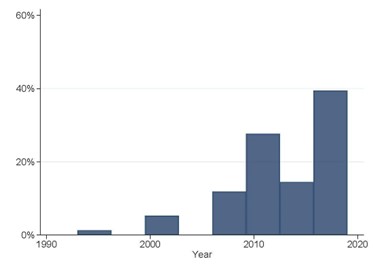

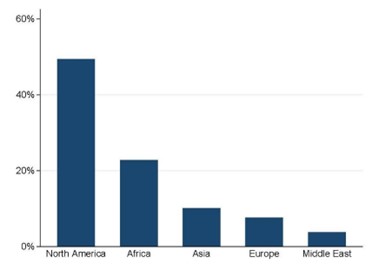

Our sample of seventy-nine impact fund side letters spans from 1993 to 2019, with a majority of agreements entered into after 2010 (see Figure 1). The sample represents forty-five funds formed across the globe with clear concentration in North America and Africa (see Figure 2).

Figure 1: Side letter execution year

Figure 2: Fund formation location by region

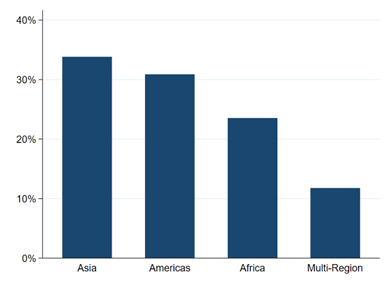

Figure 3: Geographic investment focus

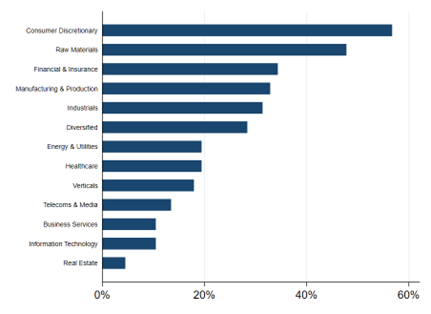

Drawing in additional data available through Preqin,116 we report additional data on matched funds including geographic focus (Figure 3) and industry focus (Figure 4). Funds don’t always form where they invest, and Figure 3 shows a more widespread distribution of geographic focal areas. Figure 4 shows a variety of investment industries for impact funds with consumer products being the most common and a cluster of funds in raw materials, financials, manufacturing, health care, industrials, and diversified assets.117

Figure 4: Industry focus

In addition to the direct document analysis, qualitative interview sessions were conceived to document and explain the dynamics contributing to the complexity and divergence we observed in the documents. As part of the grant, we focused in particular on the prevalence and strength of confidentiality clauses.

We conducted qualitative interviews on November 6, 2020, and February 5, 2021.118 Both sessions were conducted under Chatham House rules. Specific inputs are not ascribed to specific individuals or specific institutions. Interview participants were selected by grant partners because of their specific area of expertise and their familiarity with the project, and willingness to participate in at least two workshop sessions. Interviewees represented key stakeholders in the investment process: four LPs, one GP, and two representatives from a major US law firm representing GPs.

Combining quantitative document analysis with qualitative interview insights affords us a more complete and nuanced view of the role played by side letters in impact investing. We organize the presentation of our analysis below primarily around our quantitative results, weaving in insights from the interviews as appropriate. We then discuss the broader implications of these empirical patterns in Section IV.

B. Common Impact Investing Side Letter Provisions

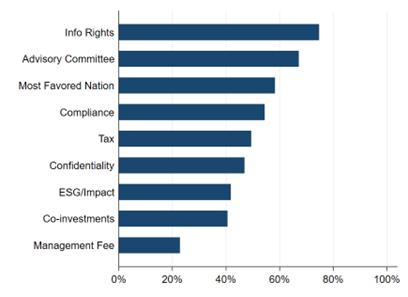

Side letters vary widely, each negotiating a bespoke resolution tailored to the idiosyncratic and infinitely variable needs of different funds and investors. Parties are effectively writing their own corporate tickets. Figure 5 provides an overview of the main provisions in our sample.

Provisions can be grouped into several buckets. In the sections below, we distinguish between provisions pertaining to investor return protections, impact protections and compliance, and governance

Figure 5: Frequency of common side letter provisions

1. Investor Return Protections

Contract terms establishing parties’ rights, priorities, and future opportunities help investors ensure a return on the capital invested into the fund. These contract terms do not set the price of the contract, like the minimum investment or the hurdle rate, but they frame an investor’s opportunity or likelihood to make money on the initial investment. Examples of investor return protections in our side letters include MFNs, co-investment rights, and management fee waivers.

In our sample, 58% of side letters contain MFNs.119 MFNs protect the holder of the right against another investor getting better individualized rights.120 For large investors that don’t see themselves as equal, but as uniquely valuable, this is especially crucial.121 One side letter in our sample presents the MFN in the following way:

Should any such side letter . . . have the effect of establishing rights or otherwise benefiting such Limited Partner in a manner more favorable in any respect to such Limited Partner than the rights and benefits established in favor of Investor by the Partnership Agreement and this letter agreement, the Investor shall automatically and without any need for any further action, receive all such rights and benefits unless and until it shall have given notice to the contrary to the General Partner.122

Other MFN variations require the fund to disclose to the investor, at the time of investment, any outstanding side letters and thereafter to provide notice of any subsequent side letters.

The General Partner has disclosed to the Investor all side letters or similar agreements (“Side Letters”) entered into by it on or prior to the date hereof with any of the Limited Partners. At any time after the date hereof should any Limited Partner receive any side letter or similar agreement from the General Partner, the Investor will be given a copy of such agreement within 30 days after the Closing Date . . . .123

MFNs ensure relative bargaining positions between investors. However, MFN rights, in traditional private market deals, apply only to investors who have made investments of equal or lesser value—so those rights do not protect investors against the bargaining power of even larger investors.124 We see such conditional MFNs in our sample, but less frequently.125

Interviewees explored one explanation for the variation in MFN rights: conflicts between multi-lateral and bi-lateral DFIs. Multi-lateral DFIs, such as the International Finance Corporation (IFC) and European Investment Bank, are private sector arms of international finance institutions with multiple private and government-backed investors.126 Multi-lateral DFIs are more demanding than their bi-lateral counterparts, and bi-lateral DFIs would ask for whatever is granted to the multi-lateral “over and beyond what they would normally require.”127

Several MFNs carve out exceptions such as for charitable foundation requirements128 or fees, 129 as well as clarifications about what is included in the MFN (e.g., “This [MFN] provision applies equally to Alternative Investment Vehicle.”).130

Co-investment terms appear in 41% of impact side letters reviewed. Co-investment provisions in our sample include language such as: “[Fund] will provide opportunities to co-invest in Portfolio Companies [and the] Investor shall be offered the opportunity to participate in any co-investment on terms no less favorable than those offered to any other potential co-investors.”131 On the substance, there is little difference between the purpose of co-investment terms in impact or private market deals—both seek to help an investor earn a higher return and serve as a weak price adjustment. But our findings are harder to interpret on the frequency: some private market reviews find high rates of co-investment, and others find much lower frequency (< 10%).132

Management fee terms, often negotiating a discount, amending reporting obligations, or clarifying carve outs, occur in 23% of our sample.133 Again, the substance of the provisions is the same in both impact and private market contexts, but the frequency may vary between the two. One law firm study found that discounted management fee provisions occur more frequently in traditional private market deals (46%) and are on the rise starting in 2018.134 Recent academic work, however, found that true fee discounts rarely occur, although the study also found a recent increase in financial-related terms overall.135 Poor performance cycles like the one caused by the onset of the global pandemic in 2020 may prompt more attention to financial terms as managers and investors alike try to massage returns in down cycles.136

Other examples of impact side letter provisions protecting investors’ returns include investor withdrawal rights,137 termination rights,138 and fee clawback provisions.139

2. Impact Protections & Compliance

Impact side letters frequently clarify expectations, add restrictions, or impose additional obligations on funds to pursue and stay faithful to a particular impact ethos.140 Here, we discuss provisions related directly to impact or compliance with impact-adjacent regulations, like anti-money laundering or program-related investments.141 Forty-two percent of side letters contained additional ESG or impact obligations. Impact terms include new commitments to collect and report impact-specific data,142 adding new social impact objectives,143 and listing prohibited investment activities antithetical to the investor’s impact ethos.144

Side letters also address the special tax or legal compliance needs of impact investors. Investors negotiate for compliance provisions focused on Anti-money Laundering/Know Your Client obligations in over 54% of our sample side letters. In 49% of side letters, funds also agree to notify investors of tax consequences triggered by investments or ones that would threaten the private foundation tax status of investors.145

Provisions excusing investors from some investments that would violate the mandates of missions of investors,146 detailing investment policies,147 and restricting certain investments are additional,148 but less frequent, terms in impact side letters.

3. Participatory Governance

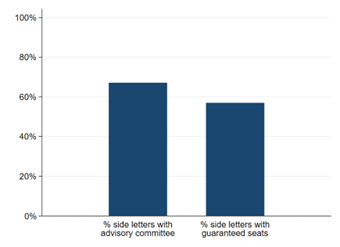

In our prior work we noted that participatory governance149 provisions appear to play a heightened role in impact investment agreements under the theory that oversight encourages fidelity to both profit and impact.150 Examples of participatory governance include investment approval, guaranteed seats on advisory committees, information and reporting rights, access and inspection rights, auditing rights, and access to Portfolio Companies.151 Of these participatory governance approaches, we highlight the three most prevalent in our sample: advisory committees (67%), information rights (75%), and confidential provisions and carve outs (47%).

a) Advisory Committees

Both traditional private market and impact investment funds negotiate advisory committee rights with large investors within side letters (see Figure 6).152 LP (investor) representatives serve on advisory boards providing both oversight of and assistance to managers.153

Figure 6: Advisory committee terms in side letters

Bargaining for advisory committee rights increases individual investors’ access to a fund manager, giving them a say in fund operations to some degree, and even the power to vote on material fund decisions.154 This is consistent with the language we see in our sample.155 Within advisory committee provisions, the majority (representing 57% of all side letters) guarantee the investor a voting seat on the committee.156

Provisions like the following are common: “[T]he Investor is entitled to appoint a representative (the “Representative”) to attend meetings of and serve as a voting member of [advisory committee] . . . . Such Representative will not be removed or replaced unless directed or consented to by the Investor in writing.”157

Investors with guaranteed seats on advisory boards can vote unconstrained by fiduciary duty—investors can freely promote their self-interest when voting.158 This concern may be lessened in the impact arena where DFIs accept concessionary returns (less incentive for selfish maneuvering) and often invest in collaboration with other DFIs, thus reducing the risk of selfish voting. The common policy objectives of DFIs and other large impact investors may make advisory committee access (if not advisory voting rights) an effective oversight tool.

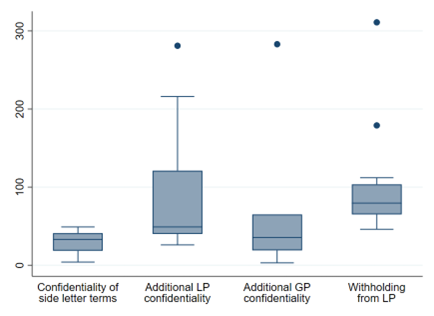

Even though the side letter provisions coalesce around advisory committee and voting rights, variation persists in how funds address side letter provisions. For example, the length of the advisory clause among side letters with advisory committee rights ranges from 15 to 363 words, with a median of 111 words.159 Side letters use bespoke language to address common themes, a form of rote customization, that illustrates both the lack of standardization and the increase in transaction costs when many investors get special treatment.

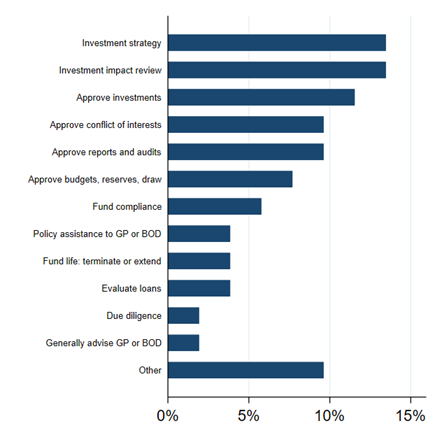

Beyond guaranteeing investors’ voting rights, advisory committee provisions define or expand the committee’s role. Figure 7 enumerates the different advisory committee roles outlined in the agreements. Note the relative low frequency overall. The most common advisory committee roles include investment strategy and impact policy oversight, as well as approving investments, conflicts of interests, and annual reports. For example, one DFI side letter guaranteed the following:

2. The General Partner, on behalf of the Fund, will submit the Fund’s E&S Management System (“ESMS”) for approval to its Advisory Committee prior to its first investment;

3. The General Partner, on behalf of the Fund, will advise and consult with the Advisory Committee regarding any proposed change in the objectives or operations of the Fund, including any material environmental or social risk posed by the proposed change; and if requested by the Advisory Committee, amend the ESMS to assess and manage such additional risks in compliance with the E&S Requirements and these provisions, in a manner reasonably acceptable to the Advisory Committee.160

Provisions in the “other” category addressed the role of the committee if the fund or managers become involved in litigation/arbitration, or if a portfolio company materially defaults or needs remediation.

Figure 7: Advisory committee roles

Taken as a whole, advisory committee provisions in impact investment side letters reallocate power to limited partners. Guaranteeing a seat on an advisory committee that oversees investments, reporting, and compliance serves as an important check on manager discretion. Even in the niche world of impact investment funds, the advisory committee side letter provisions illustrate the lack of boilerplate and a high degree of tailoring.

Investor demand for advisory committees shows that in some cases, tailored, ex ante contract rights are not enough. Some investors demand the ability to engage in oversight (and potentially renegotiate) on an ongoing basis over the fixed investment life of the fund.161 Like with private equity funds, impact LPs are locked into the investment for roughly 10 years, but unlike in private equity, impact managers balance dual goals.162 Consider this side letter provision providing information to the investor and a voice two years into the fund’s active investment cycle:

Two (2) years after the Final Closing Date we shall appoint an external ESG consultant to assess the Fund’s ESG performance against the ESGMS. We shall agree the terms of reference for such appointment with the LP Advisory Committee prior to such appointment. We shall consider and discuss with the LP Advisory Committee the analysis provided by the consultant and shall use commercially reasonable efforts to implement any reasonable recommendations made by such consultant which would be in the interest of the Fund.163

Participatory governance is an extension of the Easterbrook and Fischel notion that parties can reduce essential performance and governance terms ex ante at the time of contracting.164 In other words, parties are writing terms specific to their preferences and deal needs. With participatory governance rights in impact funds, the parties are creating a contract mechanism to monitor future performance and ensure the spirit of the contract (both profit and purpose) is fulfilled continuously over the life of the venture.165

b) Confidentiality and information rights

Confidentiality is an important deal term in many settings, but it appears to have outsize importance in impact investment agreements. Consider the 2019/2020 private market fund study that identified manager reporting obligations as a common side letter provision and subsequent academic work finding more than half of all side letters address information or confidentiality rights.166 Compare this with the 75% of impact investment side letters with information and report rights provisions (Figure 5). An additional 47% of side letters also address confidentiality obligations and carve outs.

Information rights facilitate participatory governance because they allow parties to observe outcomes important to achieving impact and return.167

If (a) any member of the LP Advisory Committee [or Fund] determines that a Portfolio Company is in material breach of any of the Integrity Requirements, or otherwise poses a material Integrity Risk, . . . [the fund] shall promptly: (i) notify each of the members of the LP Advisory Committee, (ii) in consultation with the LP Advisory Committee, require the relevant Portfolio Company to undertake, within a specified timeframe, remediation measures necessary or appropriate to remedy such breach or mitigate such Integrity Risk, which shall be approved by the LP Advisory Committee, and keep the LP Advisory Committee regularly informed of the on-going implementation of those measures; . . . [or] dispose of the Fund’s investment in such Portfolio Company on commercially reasonable terms, taking into account liquidity, market constraints and fiduciary responsibilities . . . .168

Transparency of this kind is especially important in new and evolving environments (like with impact investments), where contracting parties need to be able to rely on trust and problem solving.169 Confidentiality, on the other hand, keeps information secret and separate. Many side letter confidentiality provisions, however, create carve outs to share information. Carve outs shift the directionality of confidentiality provisions, which are usually written as barriers to transparency, oversight, and shared knowledge.

Confidentiality provisions are a window into GP-LP dynamics. Confidentiality provisions shroud impact investments in secrecy with provisions like the following:

The Limited Partners acknowledge and agree that all information provided to them by or on behalf of the Fund or the General Partner concerning the business of the Fund (including, without limitation, this Agreement and all amendments hereto, the Private Placement Memorandum and the Subscription Agreement), . . . shall not, without the prior consent of the General Partner, be (i) disclosed . . . or (ii) used . . . .170

That secrecy may make sense from a traditional GP’s perspective of proprietary investment due diligence processes and pipelines.171 Secrecy, however, is at odds with promoting capital investment in impact funds. It also conflicts with transparency policies adopted by impact investors. Foundations and DFIs, in particular, have stringent information needs in order to comply with their own monitoring, reporting, and public disclosure frameworks which require the ability to harvest and, in some cases, disclose information to the public.172 Further, deal confidentiality can exacerbate consequences for all impact investors when funds fail.173

Interviewees reported a growing tension between investors’ need and preference for transparency and GPs’ determination to maintain secrecy. This tension is highest where impact investors have lower bargaining power, such as in funds where DFIs or foundations play a less dominant role in the investor base. GPs’ ability to push back is predicated on personal preferences for secrecy and the relatively lower need they have of DFI capital.174

Confidentiality provisions are common, but not uniform, in substance, complexity, length, or even document location within LPAs and side letters.

Preferences and information needs are also idiosyncratic to each impact investor. For example, some impact investors have a specific focus on business integrity, whereas others will be more concerned about advancing policy initiatives or complying with money laundering issues, resulting in clauses of varying length and complexity.175 For DFIs, information needs are shaped by the public role that they play and much of DFI-requested information is for investment monitoring and risk management. Further, DFIs may have to negotiate the inclusion of mandatory clauses and language reflecting government policy preferences.176

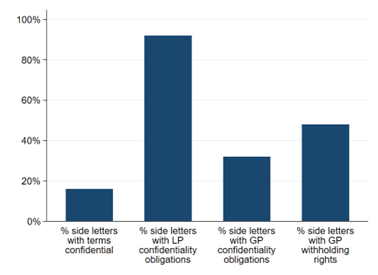

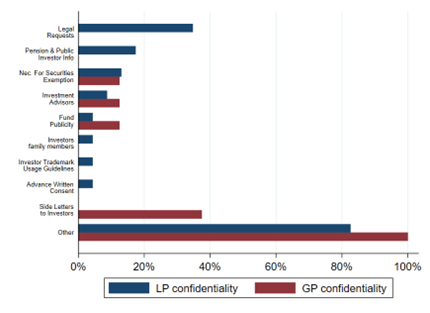

Figure 5 shows that 47% of the side letters address confidentiality. For the remainder of this section, we report detailed information about confidentiality provisions drawn from a smaller subsample (twenty-five side letters) reviewed in conjunction with the previously mentioned grant. Some letters make the agreements themselves confidential (16%) supporting the claim of secret side deals.177 Over 90% address limited partner confidentiality obligations,178 whereas only 32% address general partner confidentiality.179 GPs also negotiate for the right to keep information secret from investors (48%), in other words, to withhold information (see Figure 8 below).180

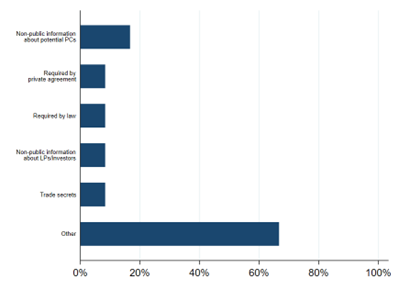

Figure 9 shows the breakouts of withholding rights, with low frequency for expected terms like “as required by law,” “nonpublic information about other investors,” or “trade secrets.” The “other” clause is the most common category, demonstrating the degree of tailoring that occurs in side letters. Some of the “other” provisions authorized managers to keep secret deal pipelines, negotiations, and even some financial distress cloistered from investors until the contract or default materialized.181

Figure 8: Additional confidentiality provisions

Figure 9: GP withholding rights

Figure 10: LP and GP confidentiality terms

Side letters vary in content and complexity, something we observe with the confidentiality clauses. Explicit and implicit carve-outs are common for both LPs and GPs. Figure 10 plots the frequency of LP (blue) and GP (red) carve outs in the documents. Most of the recorded carveouts relate to legal compliance,182 sharing information within the investor’s network or organization,183 and sharing requirements under other side letters (i.e., MFNs).184 Interestingly, the other category swamps the carveouts for both LPs and GPs. We interpret this as evidence against boilerplate and evidence of rote customization in side letters. While patterns emerge about provision type, each document has its own idiosyncrasies in scope, content, and language.

Figure 11: Confidentiality provision length

Last, but not least, side letter variation in length and complexity can be observed by word counts. For example, Figure 11 shows variation in the length of confidentiality clauses and illustrates the potential costs associated with highly tailored, complex contracting practices.

An important externality of confidentiality clauses, particularly in impact investing, is that they push agreements further into the shadows. This secrecy engenders costs in two ways. Secrecy in the terms of the side letters creates hidden hierarchies of investment rights, resulting in an asymmetry of information that can threaten the efficiency of private ordering.185 The SEC cautions in its proposed side letter rules that:

An adviser may agree to provide preferential information rights to a certain investor in exchange for something of benefit to the adviser. The proposed rule is designed to neutralize the potential for private fund advisers to treat portfolio holdings information as a commodity to be used to gain or maintain favor with particular investors.186

Secrecy in the terms of the agreements also hampers efforts to disseminate best practices that are still developing in the new space of impact investing.

IV. Discussion

Easterbrook and Fischel present contracts as a way for corporate actors to “write their own tickets,” or in other words, to promise and deliver the value that they can offer. Side letters exemplify this phenomenon: they tailor terms of existing agreements to suit the specific needs of their parties. Side letters are also ubiquitous in private market investments and, in particular, in impact investing.

A. Side Letters as Contracts

Impact investing is a useful setting to understand the opportunities and costs of side letters as contracts because of the variety of backgrounds and mandates represented by multiple investors in this space, often within the same fund. For example, DFIs represent government policy goals, and require greater transparency and accountability commensurate with their public policy mandates.187 DFIs frequently invest alongside high net worth individuals, whose preferences are their own, and who lack the government accountability needs (as well as back-office capacity) of DFIs. Other investors in impact investing include foundations, pension funds, and other institutional investors. Side letters are therefore critical tools to enable participants to dictate the terms of their engagement, but they can also impose unique costs in a still-developing space. In the rest of this section, we discuss these opportunities and costs in light of our results, before concluding with suggestions for a path forward.

We see evidence of “personalized contracts” in the lower frequency of co-investment rights and management fee reductions in impact versus non-impact side letters.188 At the same time, impact side letters place greater emphasis on information rights and advisory committees especially compared to non-impact counterparts.189 Side letter terms reflect investor priorities, which, in impact investing, center comparatively more on the nonpecuniary achievements of the fund. For readers interested in the development of impact investing generally, the prevalence and strength of impact-oriented provisions in the side letters attest to the overall growth and maturation of impact investing.190

Side letter provisions clearly answer investor needs. For example, advisory committees are governance tools responsive to the fixed investment horizon of funds (typically 10 years). Advisory committees facilitate continued oversight and engagement even after investor capital commitments are locked in. At the same time, not all investors have the desire or capacity to participate in advisory committees, and we see this manifest in the fact that advisory committees are negotiated in side letters that secure rights for some but not all investors. Moreover, we see contracts guaranteeing advisory committee seats, so advisory committee rights are not only widespread, but robust. We also do not see a single defined goal for advisory committees, but instead observe a variety of roles. In other words, advisory committee terms are not boilerplate; rather, they reflect the particular needs of specific investors.

The prevalence of information rights in impact side letters is another manifestation of tailoring provisions to specific investor needs. Information rights are the most common provision contracted for in our sample. In interviews, fund managers reported a reluctance to share the same detail of investment information with small investors compared to large investors, for a variety of reasons: small investors tend to be less well-known to fund managers due to fewer repeated interactions, and they are perceived as having lower reputational skin-in-the-game and smaller back-office compliance capabilities to ensure confidentiality is maintained.191 Many small investors also do not have the same requirement for transparency that large investors like DFIs and foundations have, due to these agencies’ public regulation.

We even see side letters negotiate rights for GPs to withhold information from LPs such as deal pipelines, financial distress of a portfolio company, or information required by law. Side letter agreements make it possible for information rights to be negotiated on a case-by-case basis, in the spirit of Easterbrook and Fischel’s “writing your own ticket” philosophy.192

B. Costs of Side Letter Contracting

Our findings demonstrate the roles of contract tailoring via side letters, but they also reveal potential costs. First, the direct costs of side letter negotiation and execution are recouped from committed capital, meaning that increasing transaction costs reduce funds deployed for impact. Funds have little incentive to curtail a practice that appeases and lures important investors without the fund footing the bill beyond byzantine compliance obligations.

Second, side letters are shadow contracts that modify investment agreement terms, often outside of the view of all investors. They create a hidden hierarchy of investment rights,193 a concern that has captured the attention of the SEC.194 For example, common side letter provisions include terms that protect investors’ return, such as MFNs. These provisions are only available to investors with the negotiated side letter right, yet they affect all investors in practice when invoked. The resulting hierarchy is hidden by virtue of being placed within side letters rather than within the main formation documents (e.g., the LPA). Other investors do not necessarily have rights to view these side letters.

In this way, the use of side letters and of confidentiality provisions can also hamper the sharing of best practices and evolution of best-in-class impact deal terms. It is not just that side letters remove incentives to strike the best bargain in LPAs, but additional measures of confidentiality keep contractual innovations secret. Investors do not even know to ask for certain rights or benefits that are reserved for the select few. Only insiders know where they can order “off the menu,” and what they may request.

Nonetheless, as we have seen, side letters serve a necessary role in spanning the gap between private market and public policy objectives. Large investors use side letters to renegotiate aspects of the investment contract and seek idiosyncratic provisions that are often tied to the goals of the backing foundation or government agency. This is most clear on the subset of confidentiality obligations where DFIs and foundations contractually embed oversight and reporting obligations as well as restrict manager discretion through prohibited investments (i.e., forced labor or outside of target regions). But shielding information from markets and the general public is counter to the public policy mandates of the government-backed investors and foundations perpetuating these practices.

Third, side letters also generate externalities from the complexity that they create. Our empirical analysis reveals a patchwork of terms with ample carve outs and little standardization that only lawyers could navigate. For example, “other” terms are the most frequent when it comes to analyzing confidentiality rights for both LPs and GPs, and the average level and variation of confidentiality clause length belies the notion of boilerplate language. Yet boilerplate not only establishes common understanding, but also reduces the need for negotiation and interpretation.195 Lack of standardization, as we see in our sample of side letters, introduces small transaction costs that add up, from negotiation, to compliance, to interpretation in the event of a default. While side letters exhibit great variation and are used to address idiosyncratic investor needs, common themes emerge in reviewing side letters, particularly with respect to information rights, advisory committees, and confidentiality. Common side letter themes should be more robustly addressed in the LPA and leave the side letters to handle truly bespoke terms. Provisions that are crucial to documenting impact and resolving profit/purpose tensions should be negotiated and documented in the LPA to develop impact-specific best practices, and not be left in the shadows of side letters. Our case study highlights opportunities to improve the existing private ordering approaches through standardization.196 In a related ongoing project, we propose a standardization menu as a starting point for negotiations to streamline the process, disrupt path dependency on out-of-date templates, and reduce the scope of negotiation.197 Further, compliance with common laws like know-your-client, tax obligations, and PRI compliance should be addressed in standardized provisions of the subscription agreement. All remaining, truly bespoke issues can be resolved in side letters, and, consistent with the proposed SEC Rules,198 those side letters should be disclosed to all current and future investors. Hierarchies created by contract are a natural feature of private ordering, but investors should not be subject to surprise terms that reshape investment rights or risks.199 Additionally, moving common side provisions to the main agreements would comply with proposed SEC prohibitions on preferential information and liquidity terms in side letters.200

C. Writing your own “ticket” on impact

Zooming out from the contents of our study and extending our findings to impact investing more broadly, we interpret our results as further evidence that the insertion of impact shapes private market investing in unique ways.201 Impact objectives are evident in information and reporting goals, as well as compliance provisions. Impact goals may also motivate the heightened need for participatory governance, like provisions guaranteeing investors a seat on an advisory committee.

In studies like this one and in other work, we observe how impact seeps into the fabric of agreements and alters the networks of contract terms.202 Impact is not bolted on as an afterthought, but it appears to be an integral negotiation point for parties.

Several aspects of the project connect with foundational theories in corporate law, some in surprising ways. Easterbrook and Fischel noted that contracts contain endless variations because objectives, motivations, and outcomes under a contract are infinite.203 They saw variation and tailoring as a feature of corporate law achieved through contracts, not as a bug. Our analysis reveals that impact investing is a particularly apt setting for tailored contracts. Lack of boilerplate and documented variation in length and complexity of side letter provisions bolster their point about the endless creative solutions that live in contracting. Easterbrook and Fischel may also interpret the side letters in the case study as clever, targeted interventions to balance power and informational needs, not as shadow contracts that hide important negotiations.

While Easterbrook and Fischel looked positively on contract variation, tailoring, and the role of private ordering, they did not look as favorably on corporate social responsibility as a whole.204 They cautioned: “A manager told to serve two masters (a little for equity holders, a little for the community) has been freed of both and is answerable to neither.”205 Perhaps they viewed the transaction costs as an insurmountable obstacle: that profits would be eroded by pursuing purpose, and in contracting around it.206 In impact investing, however, foundation and DFI money are cornerstone capital. The usual guardrails of transaction costs to curb customization soften in the face of large resources these investors have to pursue social objectives.207

For all their skepticism about the value of dual objectives, Easterbrook and Fischel imagined a world of infinite motivations and tailoring to parties’ idiosyncratic needs. They saw contracts as a means, even, to agree on pursuing purpose over (or alongside) profit. “If a bank is formed [for] the declared purpose of giving priority to loans to minority-owned businesses or third-world nations, that is a matter for the ventures to settle among themselves.”208 Venturers are, in fact, settling the matter for themselves. Impact agreements resolve the indeterminate nature of a stakeholder governance framework (a manager serving two masters serves neither) because the community’s interests are the equity holders’ interests. Further, the contract reflects the equity holder’s unique preferences and priority about which community interests to serve and how to deliver on these promises. The preferences are recorded in the contract and become an enforceable term of the deal. Private ordering, not corporate law, enables agents to serve two masters or two goals: profit and purpose. Our only quibble is how frequently the contract of choice is the side letter and not the LPA or subscription agreement.

V. Conclusion

We introduce a unique data set of side letters and impact investor interviews. These shadow contracts memorialize side deals between some, but not all investors. With our data, we document motivations for large investors to seek side letters and the most common terms of these side letters. We use our case study to identify the opportunities, like tailoring, and costs, like patchwork compliance, of side letters.

We also treat our data as a window into contract and corporate law theories. Contracts are central to promising and delivering what investors value—an emphasis that takes on new meaning as economies start to grapple with societal issues through dual purpose vehicles such as impact investing funds. Side letters are particularly useful tools to define value for large impact investors, specifically as it relates to impact monitoring and reporting. Side letters thus solve one problem specific to the investor, but they introduce other less concrete harms such as hidden hierarchies and suboptimal LPA terms. Standardizing the LPA and subscription agreement to address common side letter provisions would develop best practices in impact deals, increase transparency, and streamline side letter negotiation and compliance. Disclosure of any remaining side letters would also be consistent with proposed SEC rules on side letters in private market funds.

- 2See, e.g., Eric A. Posner, Parol Evidence Rule, the Plain Meaning Rule, and the Principles of Contractual Interpretation, 146 U. Pa. L. Rev. 533, 534–35 (1998) (describing the role of written contracts as providing the best evidence of the parties’ intent to create a complete contract).

- 3E. Allan Farnsworth, Farnsworth on Contracts 225 (3d ed. 2004); see also John E. Murray, Jr., The Parol Evidence Process and Standardized Agreements Under the Restatement (Second) of Contracts, 123 U. Pa. L. Rev. 1342, 1387–88 (1975).

- 4Restatement (Second) of Contracts § 279 (Am. L. Inst. 1981); cf. David Horton, The Shadow Terms: Contract Procedure and Unilateral Amendments, 57 UCLA L. Rev. 605, 605 (2010) (pointing out that “many standard form consumer agreements . . . authorize drafters to revise procedural terms unilaterally”).

- 5William W. Clayton, The Private Equity Negotiation Myth, 37 Yale J. on Regul. 67, 91 (2020) (describing how in a side letter “the benefit of the negotiated bargain is not shared with all of the other investors in the fund” but only “appl[ies] to the investor that is the recipient of the side letter”).

- 6Id. The SEC recently defined side letters as “agreements among the investor, general partner, adviser, and/or the private fund that provide the investor with different or preferential terms than those set forth in the fund’s governing documents.” Private Fund Advisors; Documentation of Registered Investment Adviser Compliance Reviews, 87 Fed. Reg. 16,886, 16,928 (proposed Mar. 24, 2022) [hereinafter Proposed Private Fund Rules], https://perma.cc/6DPL-HSUP.

- 7William W. Clayton, Public Investors, Private Funds, and State Law, 72 Baylor L. Rev. 294, 316 (2020); William Magnuson, The Public Cost of Private Equity, 102 Minn. L. Rev. 1847, 1886–87 (2018) (“Many of these arrangements go undisclosed to other, less-preferred investors . . . .”); cf. James M. Schell et al., Private Equity Funds: Business Structures and Operations § 11.14 (identifying an exception to secrecy: the most favored nations clause, which entitles the holder of these rights, usually in their own side letters, to see side letter terms equal to or more favorable than the terms granted to it).

- 8Magnuson, supra note 6, at 1886 (discussing most favored nations provisions).

- 9

The private corporation or firm is simply one form of legal fiction which serves as a nexus for contracting relationships, and which is also characterized by the existence of divisible residual claims on the assets and cash flows of the organization which can generally be sold without permission of the other contracting individuals. While this definition of the firm has little substantive content, emphasizing the essential contractual nature of firms and other organizations focuses attention on a crucial set of questions—why particular sets of contractual relations arise for various types of organizations, what are the consequences of these contractual relationships, and how they are affected by changes exogenous to the organization?

Michael C. Jensen & William H. Meckling, Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure, 3 J. Fin. Econ. 305, 311 (1976). See also Henry Hansmann, The Ownership of Enterprise 18 (1996) (describing the firm as “a nexus of contracts,” by which he means that the “firm is in essence the common signatory of a group of contracts” among various factors of production); Stephen M. Bainbridge, The Board of Directors as Nexus of Contracts: A Critique of Gulati, Klein & Zolt’s “Connected Contracts” Model, 88 Iowa L. Rev. 1, 18 (2002); Melvin A. Eisenberg, The Conception That the Corporation Is a Nexus of Contracts, and the Dual Nature of the Firm, 24 J. Corp. L. 819, 819–23 (1999); Marleen A. O’Connor, Restructuring the Corporation’s Nexus of Contracts: Recognizing a Fiduciary Duty to Protect Displaced Workers, 69 N.C. L. Rev. 1189, 1193 (1991).

- 10Margaret M. Blair & Lynn A. Stout, A Team Production Theory of Corporate Law, 85 Va. L. Rev. 247, 250–51 (1999).

- 11Salzberg v. Sciabacucchi, 227 A.3d 102, 116 (Del. 2020) (“[R]ecognizing that corporate charters are contracts among a corporation’s stockholders, stockholder-approved charter amendments are given great respect under our law.”); see also ESG Cap. Partners II, LP v. Passport Special Opportunities Master Fund, LP, No. CV 11053, 2015 WL 9060982, at *13 (Del. Ch. Dec. 16, 2015) (holding a general partner lacked authority, under the partnership agreement, to subsequently grant prohibited rights to select investors).

- 12Id.; see also Magnuson, supra note 6, at 1875 (“[I]nvestor rights are largely a creature of contract law, and not state or federal law as one finds with publicly listed companies.”).

- 13Frank H. Easterbrook & Daniel R. Fischel, Economic Structure of Corporate Law 2 (1996) [hereinafter Easterbrook & Fischel, Economic Structure]; Frank H. Easterbrook & Daniel R. Fischel, The Corporate Contract, 89 Colum. L. Rev. 1416, 1417–18 (1989) [hereinafter Easterbrook & Fischel, Corporate Contract].

- 14Easterbrook & Fischel, Corporate Contract, supra note 12, at 1417–18.

- 15The phrase contract primacy was used by Judge Easterbrook at the University of Chicago Symposium: The Economic Structure of Corporate Law at Thirty: A Retrospective on the Work of Easterbrook and Fischel (March 25, 2022). Contract primacy offers an alternative framework to shareholder primacy and director primacy theories advanced in the corporate law literature. See, e.g., Lucian Arye Bebchuk, The Case for Increasing Shareholder Power, 118 Harv. L. Rev. 833, 836 (2005) (arguing for increased shareholder power to hold managers accountable and improve corporate performance); Stephen M. Bainbridge, Director Primacy and Shareholder Disempowerment, 119 Harv. L. Rev. 1735 (2006) (arguing for continued rules that place directors largely in control of corporations with limited shareholder voting rights).

- 16Henry E. Smith, Modularity in Contracts: Boilerplate and Information Flow, 104 Mich. L. Rev. 1175, 1176, 1196 (2006); Spencer Williams, Contracts as Systems, 45 Del. J. Corp. L. 219, 237–38 (2021).

- 17Smith, supra note 15, at 1189 (cross referencing works against modularity and instead creates interdependence); see also Cathy Hwang & Matthew Jennejohn, Deal Structure, 113 Nw. U. L. Rev. 279, 305 (2018) (“Integration can be understood as the opposite of modularity—an integrated system has direct connections between the various constituent units. Most often, separate components are purpose-built to work together, and a change in one part causes changes in another.”). See, e.g., Restatement (Second) of Contracts, supra note 3, at § 209(3) (“Where the parties reduce an agreement to a writing which in view of its completeness and specificity reasonably appears to be a complete agreement, it is taken to be an integrated agreement unless it is established by other evidence that the writing did not constitute a final expression.”).

- 18See, e.g., Ola Bengtsson & Dan Bernhardt, Different Problem, Same Solution: Contract-Specialization in Venture Capital, 23 J. Econ. & Mgmt. Strat. 396, 397 (2014) (describing findings that VCs appropriately tailored financial contracts to maximize compensation, reputation, and future fund-raising ability).

- 19Standard price, payment terms, duration, delivery terms, and many others gap fillers in the law promote standardized contract language. See Omri Ben-Shahar, “Agreeing to Disagree”: Filling Gaps in Deliberately Incomplete Contracts, 2004 Wis. L. Rev. 389, 394 (2004) (first citing U.C.C. § 2–204 (2002); and then citing Restatement (Second) of Contracts, supra note 3, at § 33); Jeremy McClane, Boilerplate Semantics: Judging Natural Language in Standard Deal Contracts, 2020 Wis. L. Rev. 595, 610–624 (2020) (describing different contract clauses like change control and pari passu).

- 20For a discussion of such boilerplate language, see Smith, supra note 15; Michelle E. Boardman, Contra Proferentem: The Allure of Ambiguous Boilerplate, 104 Mich. L. Rev. 1105, 1107 (2006) (arguing that boilerplate terms carry less litigation uncertainty and therefore reduce transaction costs); Mitu Gulati & Robert Scott, The 3 ½ Minute Transaction 2–3 (2012) (discussing the widespread use of a boilerplate pari passu term in sovereign bond contracts); Charles J. Goetz & Robert E. Scott, The Limits of Expanded Choice: An Analysis of the Interactions Between Express and Implied Contract Terms, 73 Cal. L. Rev. 261, 262 (1985) (noting that default contract terms reduce transaction costs by providing parties with standardized and generally applicable “preformulations”).

- 21For example, see standard side letter language:

In connection with the investment by the Investor in XX, an X limited partnership (the “Partnership”) which is constituted pursuant to the limited partnership agreement dated X, as amended and restated on X and as further amended, restated or modified from time to time (the “Partnership Agreement”) and as an inducement for investment by the Investor in the Partnership, the General Partner has agreed to provide the Investor with this letter agreement (this “Side Letter”), which grants certain rights and benefits to the Investor with respect to his investment in the Partnership. This Side Letter shall supplement the terms of the Partnership Agreement.

Side Letter Doc. 39 (on file with authors).

- 22Cathy Hwang, Unbundled Bargains: Multi-Agreement Dealmaking in Complex Mergers and Acquisitions, 164 U. Pa. L. Rev. 1403, 1418–23 (2016).

- 23See, e.g., Proposed Private Fund Rules, supra note 5, at 16,930 (describing “excuse rights” to shield certain investors from contributing money to portfolio companies that violate the investor’s “environmental, social, or governance standards”).

- 24The Global Impact Investing Network defines impact investing as “investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. Impact investments can be made in both emerging and developed markets and target a range of returns from below market to market rate, depending on investors’ strategic goals.” What You Need to Know about Impact Investing, Glob. Impact Inv. Network, https://perma.cc/PA32-ZFLU (last visited Feb. 8, 2022).

- 25Christopher Geczy et al., Contracts with (Social) Benefits: The Implementation of Impact Investing, 142 J. Fin. Econ. 697 (2021).

- 26Id. at 697.

- 27See Impact Fin. Rsch. Consortium, https://perma.cc/8NBV-SLR2 (last visited Feb. 8, 2022).

- 28Helpful published works include Clayton, supra note 4; Clayton, supra note 6; and Magnuson, supra note 6. See also Kenneth Ayotte et al., Bankruptcy on the Side, 112 Nw. L. Rev. 255 (2017) (analyzing side agreements between creditors in bankruptcy proceedings). Professors Elisabeth DeFontenay and Yaron Nili have a to-date unpublished empirical study drawing on over 250 side letters in private market deals. Elisabeth de Fontenay & Yaron Nili, Side Letter Governance, Wash U. L. Rev. (forthcoming), https://perma.cc/8B38-WSSJ.

- 29

Investors part with their money willingly, putting dollars in equities instead of bonds or banks or land or gold because they believe the returns of equities more attractive. . . . Firms begin small in growth. They must attract customers and investors by promising and delivering what those people value. [Firms] that do not do so will not survive.

Easterbrook & Fischel, Economic Structure, supra note 12, at 4.

- 30The SEC supported its proposed side letter disclosure rule stating that “[i]ncreased transparency would better inform investors regarding the breadth of preferential treatment, the potential for those terms to affect their investment in the private fund, and the potential costs (including compliance costs) associated with these preferential terms.” Proposed Private Fund Rules, supra note 5, at 16,930.

- 31See, e.g., Bhd. of Locomotive Eng’rs & Trainmen v. United Transp. Union, No. 10CV1532, 2011 WL 4478495, at *4 (N.D. Ohio Sept. 26, 2011), aff’d, 700 F.3d 891 (6th Cir. 2012) (interpreting two side letter agreements that modified a 1996 collective bargaining agreement and effectively determined employee rank for the positions covered in the side letter).

- 32Red Zone LLC v. Cadwalader, Wickersham & Taft LLP, 994 N.Y.S.2d 764, 769 (N.Y. Sup. Ct. 2013) (litigating a side letter to an investment banking agreement that reduced the representation services from $10 million to $2 million if the investment bank facilitated a proxy contest rather than a tender offer).

- 33See, e.g., Ian Levin & Kevin Scanlan, The Downside of Side Letters, 7 J. Inv. Compliance 43, 43–47 (2006) (noting that common practice of side letters in private equity in 2006); Clayton, supra note 4, at 91 (“[I]t is extremely common for large private equity fund investors to negotiate for various forms of individualized benefits in private equity funds.”). For a primer on private equity, see Priv. Equity Rsch. Consortium & Inst. for Priv. Cap., Debt and Leverage in Private Equity: A Survey of Existing Results and New Findings (2021), https://perma.cc/M9QK-WEBY.

- 34Houman B. Shadab, Hedge Fund Governance, 19 Stan. J.L. Bus. & Fin. 141, 170 (2013); see also Magnuson, supra note 6, at 1875.